- The Japanese Yen draws some support from the possibility of a government intervention.

- The divergent BoJ-Fed expectations and easing Middle East tensions cap the safe-haven JPY.

- Traders also seem reluctant ahead of the key US macro data and BoJ meeting later this week.

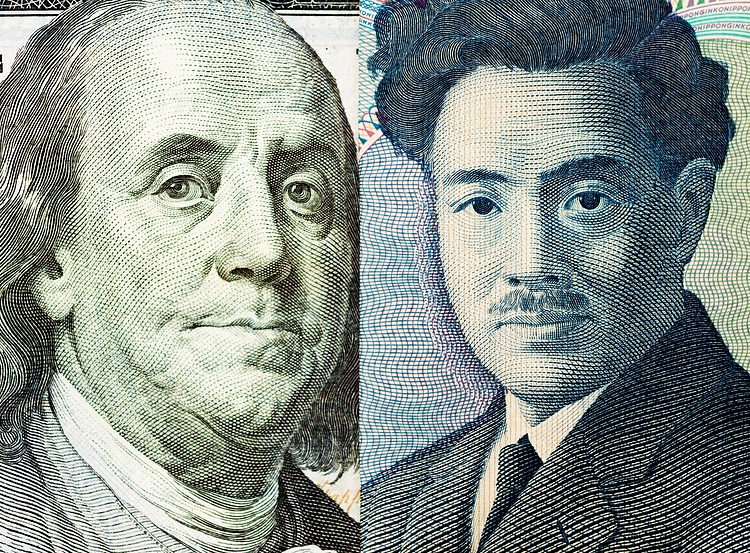

The Japanese Yen (JPY) struggles to capitalize on its modest Asian session gains and languishes near a 34-year trough touched against its American counterpart the previous day. The Bank of Japan (BoJ) indicated that it is in no rush in terms of policy normalization, while the Federal Reserve (Fed) is expected to delay cutting interest rates amid sticky inflation. This suggests that the difference in rates between the US and Japan will stay wide, which, along with easing geopolitical tensions in the Middle East, continues to undermine the safe-haven JPY.

The US Dollar (USD), on the other hand, remains well within the striking distance of its highest level since November set last week amid hawkish Fed expectations and turns out to be another factor acting as a tailwind for the USD/JPY pair. That said, fresh warnings by Japanese authorities, against excessive currency market moves, hold back the JPY bears from placing aggressive bets. Investors also prefer to wait on the sidelines ahead of the BoJ decision on Friday, which, along with important US macro data, should provide a fresh impetus to the pair.

- Japan’s Finance Minister Shunichi Suzuki, along with other policymakers, said that they are watching currency moves closely and will respond as needed, providing some respite to the Japanese Yen.

- The flash PMIs released from Japan on Tuesday showed that overall business activity improved substantially at the beginning of the second quarter, albeit did little to impress the JPY bulls.

- The au Jibun Bank Japan Manufacturing PMI moved closer to breaking back into expansionary territory and improved from 48.2 to 49.9 in April – marking the strongest reading since June 2023.

- The gauge for the services sector came in at 54.6 for the reported month as compared to 54.1 in March, suggesting that demand remained strong despite weakness in other aspects of the economy.

- Following last month’s historic decision to end the negative rate policy and Yield Curve Control (YCC) program, the Bank of Japan is expected to keep its short-term interest target unchanged on Friday.

- Moreover, the BoJ is anticipated to adopt a data-dependent approach in deciding the next interest rate hike amid uncertainties on whether wage hikes will broaden and drive up consumer prices.

- Investors pushed back their expectations about the timing of the first rate cut by the Federal Reserve to September and downsized the number of rate cuts this year to less than two amid sticky inflation.

- Adding to this, the recent hawkish remarks by FOMC members allow the US Dollar to stand tall near its highest level since November touched last week and act as a tailwind for the USD/JPY pair.

- Traders now look to the flash US PMIs for some impetus, though the focus remains on the Advance US Q1 GDP on Thursday and the Personal Consumption Expenditures (PCE) Price Index on Friday.

From a technical perspective, the Relative Strength Index (RSI) is still flashing overbought conditions on the daily chart and holding back the USD/JPY pair from placing fresh bets. Any further slide, however, is more likely to attract some dip-buyers near the 154.35-154.30 region. This should help limit the downside for spot prices near the 154.00 mark, which, if broken, might expose last Friday’s swing low, around the 153.60-153.55 zone. The next relevant support is pegged near the 153.25-153.20 area and the 153.00 mark. A convincing break below the latter could prompt aggressive technical selling and drag the pair to the 152.50 intermediate support en route to a short-term trading range resistance breakpoint near the 152.00 round figure.

On the flip side, the multi-decade high, around the 154.85 region touched on Monday, followed by the 155.00 psychological mark, could act as an immediate hurdle. A sustained strength beyond the latter will be seen as a fresh trigger for bullish traders and set the stage for an extension of a well-established appreciating trend from the March monthly swing low.