- Gold retreated marginally from all-time highs as US T-bond yields edged higher.

- Near-term technical outlook shows XAU/USD is still overbought.

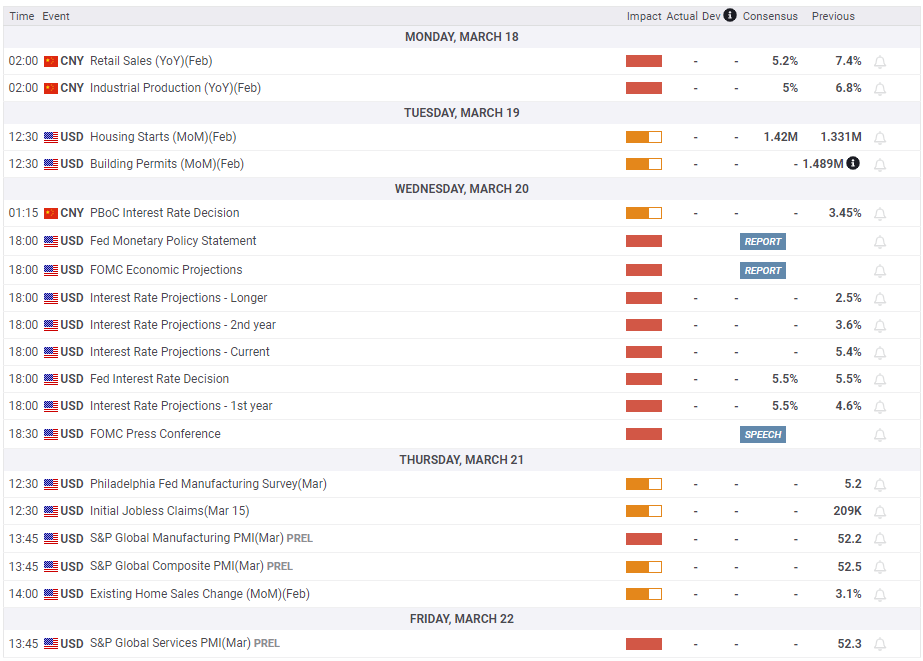

- The Fed will announce policy decisions and publish the dot plot next week.

Following the previous week’s record-setting rally, Gold staged a correction this week, pressured by recovering US Treasury bond yields. The Federal Reserve’s (Fed) policy announcements and the revised Summary of Projections (SEP) next week could help markets decide whether XAU/USD will target new all-time highs or extend its downward correction.

Gold price edged lower as US yields recovered on US data

Markets started the new week on a slow note and Gold struggled to gather directional momentum, closing with small gains on Monday. On Tuesday, the Bureau of Labor Statistics (BLS) announced that annual inflation in the US, as measured by the change in the Consumer Price Index (CPI), edged higher to 3.2% in February from 3.1% in January. On a monthly basis, the CPI and the Core CPI both rose 0.4%. The benchmark 10-year US Treasury bond yield rose more than 1% after the data and caused XAU/USD to snap a nine-day winning streak by losing over 1% on the day.

In the absence of high-tier data releases on Wednesday, Gold went into a consolidation phase and managed to erase a portion of Tuesday’s losses.

The BLS said on Thursday that the annual Producer Price Index (PPI) rose 1.6% in February, following the 1% increase recorded in January and surpassing the market expectation of 1.1% by a wide margin. Other data from the US showed that Retail Sales increased 0.6% on a monthly basis in February after falling 1.1% in January, while the number of first-time applications for unemployment benefits edged lower to 209,000 in the week ending March 9 from 210,000. Following these data releases, investors started reassessing the timing of the Federal Reserve (Fed) policy pivot. According to the CME FedWacth Tool, the probability of the Fed leaving the policy rate unchanged at 5.25%-5.% range in June climbed to 40% from below 30% ahead of the data. The 10-year US yield extended its uptrend and advanced to its highest level in two weeks at 4.3%. In turn, Gold came under renewed bearish pressure and dropped below $2.160.

As the 10-year yield staged a downward correction early Friday, Gold regained its traction and recovered to the $2,170 area. Later in the session, however, XAU/USD retraced its daily rebound to end the week in negative territory.

Gold price needs a dovish Fed surprise to target new record high

The Fed will announce monetary policy decisions and publish the revised Summary of Economic Projections (SEP), the so-called dot plot, on Wednesday. The Fed is widely expected to leave the monetary policy settings unchanged.

In December, the dot plot showed that Fed policymakers were forecasting a total of 75 basis points (bps) of rate cuts in 2024. The CME FedWatch Tool shows that markets are pricing in a nearly 70% probability that the policy rate will be lowered by at least 75 bps after the Fed’s policy meeting in December.

In case the SEP shows that policymakers are leaning toward a total of 50 bps rate cuts this year, the market positioning suggests that the initial reaction could provide a boost to the USD. Investors will also pay close attention to inflation forecasts. If the inflation projection for 2024, which was 2.4% in December’s SEP, is left unchanged or revised higher despite a shift toward 50 bps cuts, this could amplify the positive impact on the USD.

On the other hand, the USD could come under renewed selling pressure if the dot plot shows that policymakers still favor a total of 75 bps cuts in 2024. A downward revision to the inflation forecast could also be seen as a dovish development. In this scenario, a steady decline in the 10-year US yield could fuel another leg higher in XAU/USD.

Once the knee-jerk reaction to the Fed policy statement and the SEP fades away, investors will pay close attention to comments from Fed Chairman Jerome Powell in the post-meeting press conference. At this point, markets are fairly certain that the policy rate will remain unchanged in May. There is, however, uncertainty regarding a possible action in June. If Powell leaves the door open to a rate cut in June, the USD could struggle to stay resilient against its rivals even if the SEP points to a hawkish tilt in the near-term policy outlook. In case Powell adopts a cautious tone regarding the inflation outlook and refrains from signalling a policy pivot in June, XAU/USD is likely to stay under bearish pressure.

The Bank of Japan (BoJ) and the Bank of England (BoE) will also be announcing policy decisions next week. Although these events are unlikely to have a direct impact on Gold’s valuation, they could influence XAU/USD’s near-term action by driving the USD demand. There is growing speculation that the BoJ could end the negative interest rate policy. A rate hike by the BoJ early Tuesday could trigger capital outflows out of the USD and help XAU/USD edge higher during the Asian trading hours.

It’s a bit more tricky to assess the potential impact of the BoE decisions on XAU/USD because they will be released on Thursday after the Fed event. If both banks deliver hawkish surprises, XAU/USD is likely to stay on the back foot. In case the Fed stays hawkish while the BoE adopts a more cautious tone regarding a further extension of the restrictive policy, this could be seen as a policy divergence and provide an additional boost to the USD. In this scenario, however, Gold could also capture capital outflows out of Pound Sterling.

Gold technical outlook

Despite the recent correction, the daily Relative Strength Index (RSI) indicator on the daily chart stays above 70, suggesting that Gold is still technically overbought.

On the downside, static support seems to have formed at $2,150. In case XAU/USD drops below that level and starts using it as resistance, an extended correction toward $2,100 (midpoint of the ascending regression channel coming from October) could be seen.

Looking north, first resistance is located at $2,180 (upper limit of the ascending channel) before $2,200 (round level). A daily close above $2,200 could attract additional buyers, but it’s difficult to set a bullish target.

Fed FAQs

Monetary policy in the US is shaped by the Federal Reserve (Fed). The Fed has two mandates: to achieve price stability and foster full employment. Its primary tool to achieve these goals is by adjusting interest rates. When prices are rising too quickly and inflation is above the Fed’s 2% target, it raises interest rates, increasing borrowing costs throughout the economy. This results in a stronger US Dollar (USD) as it makes the US a more attractive place for international investors to park their money. When inflation falls below 2% or the Unemployment Rate is too high, the Fed may lower interest rates to encourage borrowing, which weighs on the Greenback.

The Federal Reserve (Fed) holds eight policy meetings a year, where the Federal Open Market Committee (FOMC) assesses economic conditions and makes monetary policy decisions. The FOMC is attended by twelve Fed officials – the seven members of the Board of Governors, the president of the Federal Reserve Bank of New York, and four of the remaining eleven regional Reserve Bank presidents, who serve one-year terms on a rotating basis.

In extreme situations, the Federal Reserve may resort to a policy named Quantitative Easing (QE). QE is the process by which the Fed substantially increases the flow of credit in a stuck financial system. It is a non-standard policy measure used during crises or when inflation is extremely low. It was the Fed’s weapon of choice during the Great Financial Crisis in 2008. It involves the Fed printing more Dollars and using them to buy high grade bonds from financial institutions. QE usually weakens the US Dollar.

Quantitative tightening (QT) is the reverse process of QE, whereby the Federal Reserve stops buying bonds from financial institutions and does not reinvest the principal from the bonds it holds maturing, to purchase new bonds. It is usually positive for the value of the US Dollar.