The introduction of stablecoins has highlighted a decades-old problem: despite all the tech innovations and dynamics, the payment sector remains slow, unfair, and opaque. They pointed up the need to facilitate access to financial services and cross-border

payments. But most importantly, they have come to the forefront of those changes and innovations. Seamlessly and quietly, stablecoins have turned into payment rails for banks, financial institutions, and regular consumers. So, when people ask you if you are

already a stablecoin user or not, don’t be too quick to say, “No”. Maybe you just do see that.

Visa and Mastercard are actively adopting stablecoins to enhance their payment processing capabilities. For example, Visa has expanded its stablecoin settlement capabilities to the Solana blockchain and is working with merchant acquirers like Worldpay and

Nuvei. This follows successful pilots, such as the one with Crypto.com, which utilized USDC for settlements, illustrating a significant move towards modernizing cross-border money movement.

Stablecoin settlements have already outperformed American Express and Mastercard. You may say that this comparison is not fair, as credit card transactions illustrate consumer spending and stable assets are utilized for DeFi and crypto trading. However,

it is no longer a matter of if but when that will change. And as soon as the majority of transactions will be settled or powered by stablecoins, the volumes will go through the roof. Don’t you see that yet?

The figure below showcases the USD-pegged stablecoin supply in all chains.

More market participants, including Visa and Mastercard, are actively adopting stablecoins to enhance payment processing capabilities. Visa has expanded its stablecoin settlement capabilities to the Solana blockchain and works with merchant acquirers like

Worldpay and Nuvei. This follows successful pilots, such as the one with Crypto.com, which utilized USDC for settlements, illustrating a significant move towards modernizing cross-border money movement.

Stablecoins and payments: a match made in heaven

We all know what happens if we try to settle a transaction on weekends, when markets are closed, or it’s a cross-border transaction. Settlements take T+3/T+infinity. Meanwhile, with stablecoins it is processed 24/7 and instantly. They used to act as a highway

for cross-border fiat payments.

However, stablecoins are currently seen as a vital bridge between different worlds in the payment ecosystem. They make transactions faster, more cost-effective, and more trustable, especially when we are talking about emerging markets or some rare currencies.

Their use allows for nearly instant payment authorizations and streamlines the fund movement between banks, reducing the time and complexity associated with international wire transfers.

With that said, the proliferation of stablecoins into the payment sector shouldn’t surprise anyone. This seamless blend of digital and traditional finance ensures that companies can leverage the benefits of stablecoins while still connecting with the conventional

financial system.

The adoption of stablecoins by international payment systems is the most prominent use case due to their cross-border and cost-efficient nature. In 2022, the total value settled by stablecoins on-chain exceeded

$11 trillion, almost outpacing Visa’s payment volume ($11.6 trillion), demonstrating their growing importance in the global financial landscape.

Financial institutions, stablecoins, and non-public integration

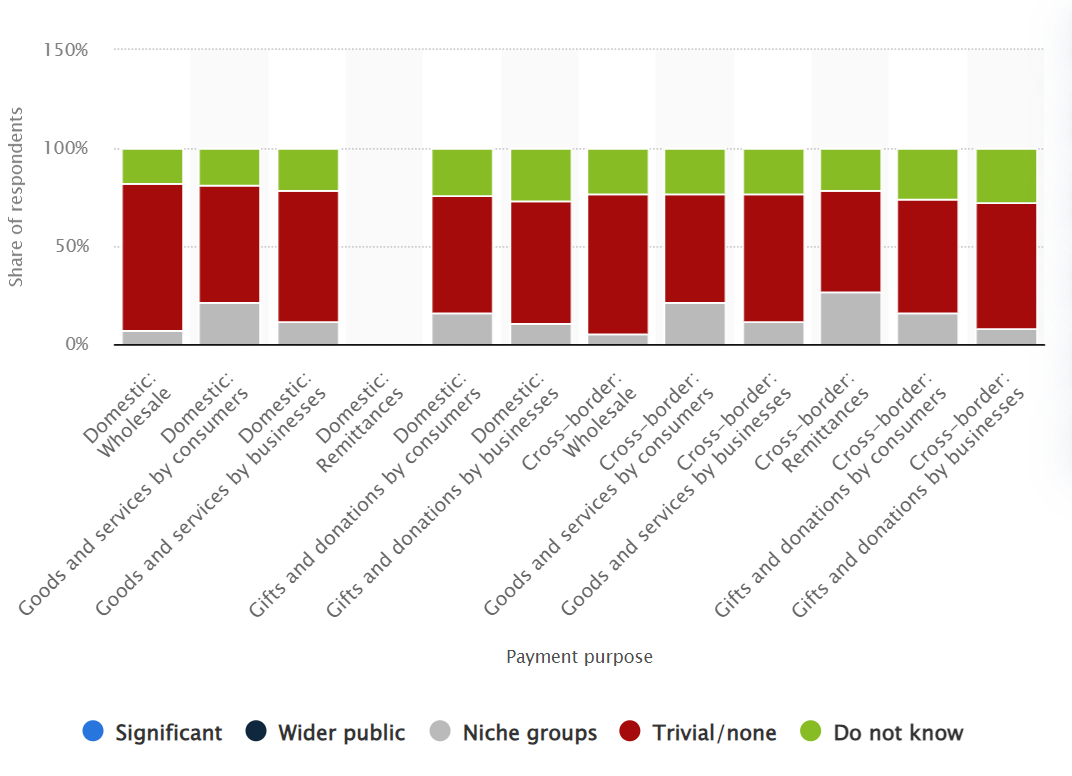

Despite all the benefits of traditional currencies-pegged assets, the global adoption rate of stablecoins as a payment method is still on the rise. Statista shares data regarding stablecoins used for payments outside the crypto ecosystem according to central

banks worldwide and you can see it below:

Relatively low adoption rates are mainly explained by demographic factors, like the average age of the local population. However, I’d mention the efforts of central banks not to notice the progress that many fintechs have already made together with the maturity

of the economy and local governmental support. That’s even despite the interoperability challenges that include technical integration difficulties, regulatory compliance, and their snowball effect, leading to the sluggishness of legacy infrastructure, limited

budget, lack of talent, and more.

The interoperability between traditional financial systems and blockchain-based payments, including stablecoins, is crucial for enabling advanced payment methods. With the adoption of MICA, that’s already our tomorrow. Ensuring systems can work together

seamlessly is critical to widespread adoption. However, that’s a completely understandable problem that has battle-tested solutions on the market.

So, what may be done here? Integrating third-party solutions and SaaS payment platforms can make payments faster and cheaper using interoperability benefits, including stablecoins. Several great market participants have solid expertise in this area, and

the industry continues to grow as new players spring up like mushrooms.

Eventually, businesses will continue trying to increase efficiency, lower operating costs, and improve competitiveness. Whatever the goal, many companies adopt modern technologies behind the scenes, making such innovations invisible to end consumers. With

such an under-the-hood integration approach, they can leverage new payment technologies without disrupting their existing operational processes. So, maybe the companies you choose and use daily already use stablecoins for payments? Who knows!