- Cryptocurrency markets have lost $230 billion in market capitalization in just six days.

- This move comes as Bitcoin shed 11.65% from its all-time high of $73,949 in the last five days.

- The AI category of altcoins contributed the most to the recent crash by losing 41% of their value in the past week.

The two most important contribution to the ongoing bull market is the meteoric rise in Bitcoin due to the ETF approval and the sudden interest spike in Solana ecosystem. But the recent move suggests that the upward momentum is dissipating and a correction looms.

Also read: Bitcoin Weekly Forecast: Can BTC hit $100,000 without a correction?

Crypto’s recent bull rally

Despite the massive popularity of Solana and the meme coins, they are dependent largely on Bitcoin’s cues for directional bias. As long as BTC continued to climb higher, the altcoin markets soared – Artificial Intelligence (AI) sector and meme coin categories continued to outperform and yielded massive gains.

As mentioned in previous publications, Worldcoin (WLD) and Fetch.AI are two notable altcoins that surged roughly 500%. Meme coins like dogwifhat (WIF) and Book of Memes (BOME) have also registered meteoric gains as well.

Although ETF flows have stabilized, Bitcoin price seems to be slowing down after 54% year-to-date returns. From the start of 2023, the pioneer crypto has shot up 347%.

BTC/USDT 1-day chart

Why is the crypto market crashing?

On the weekly time frame, Bitcoin price has created a bearish swing failure pattern (SFP). Since this SFP led to BTC closing below the previous ATH of $69,000, investors should exercise caution.

BTC/USDT 1-week chart

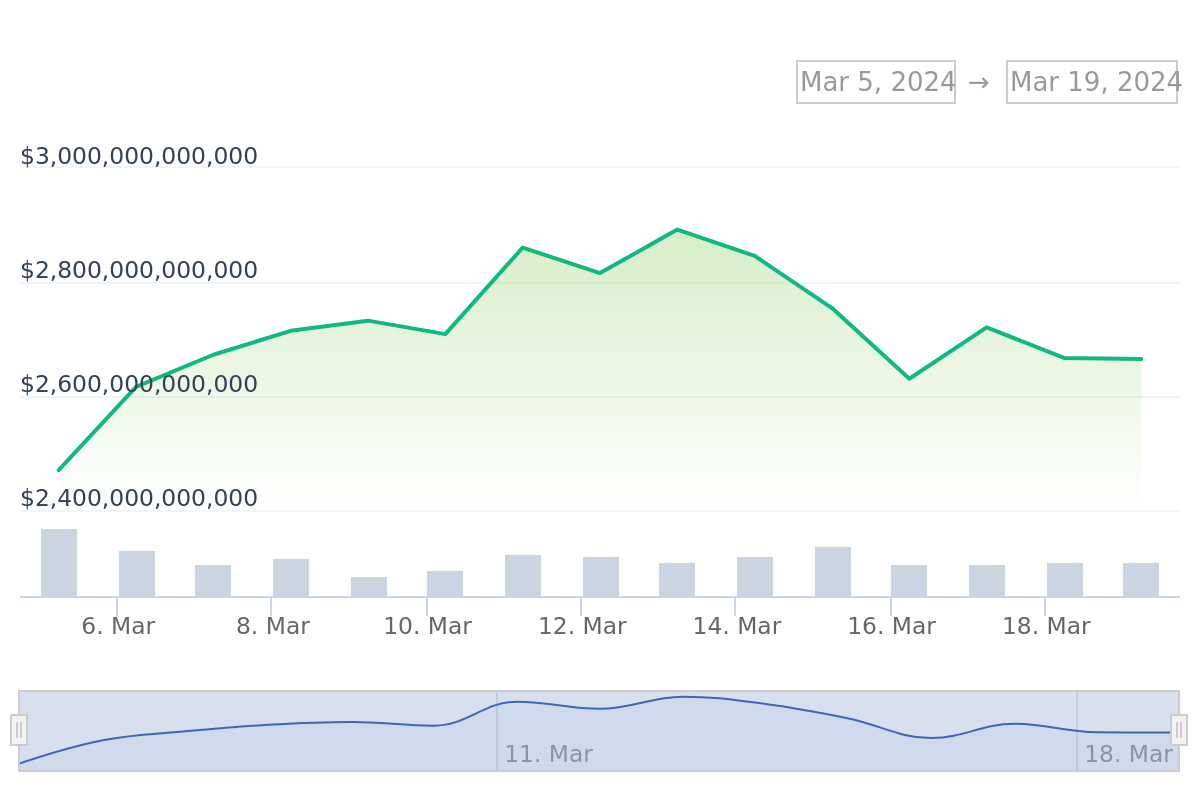

As mentioned in the previous article, BTC’s momentum is slowing down, which could be one of the main reasons why the market is crashing. This short-term waning of buying pressure has resulted in market participants booking profits, resulting in the total cryptocurrency market capitalization heading down from $2.89 trillion to $2.66 trillion, according to CoinGecko data.

Crypto market capitalization

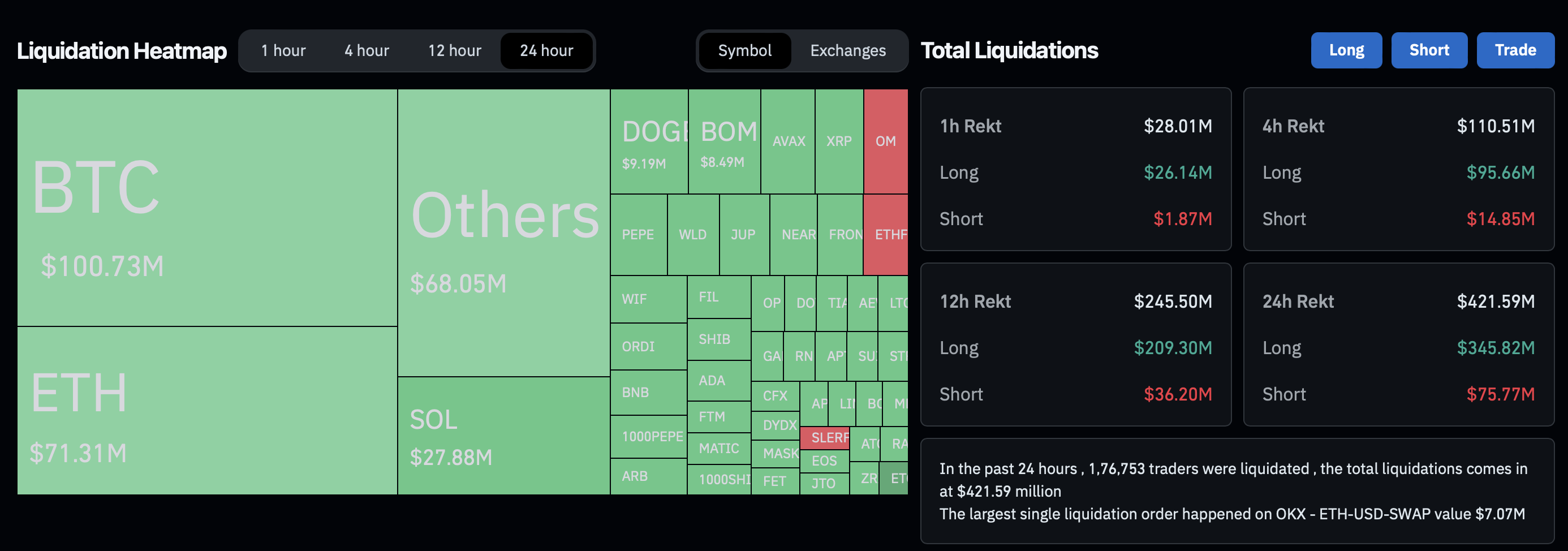

According to CoinGlass data, Bitcoin price has shed nearly 10% in the last four days, leading to $400 million in total liquidations in just the past 24 hours. In the last 24-hours, BTC long traders’ positions worth $100 million have been wiped out, along with $71 million in Ethereum and $28 million in Solana.

Crypto liquidation heatmap

This development is only likely to continue if Bitcoin price continues to slide lower.