- The United States Federal Reserve still aims for three rate cuts this year, trusts the economy will improve further.

- US core Personal Consumption Expenditures (PCE) Price Index is seen easing in February.

- EUR/USD gains downward traction in the long term and could fall towards 1.0520.

The EUR/USD pair fell for a second consecutive week, ending Friday just above the March low of 1.0796. The pair peaked at 1.0942 early on Thursday, in the aftermath of the Federal Reserve (Fed) monetary policy announcement, but turned south afterwards, as the US Dollar (USD) benefited from optimism about the US economy’s performance.

The US Fed announced its decision on Wednesday, and as widely anticipated, policymakers left the benchmark interest rate floating between 5.25% and 5.50%. The central bank also released its quarterly Summary of Economic Projections (SEP) or dot plot, showing policymakers’ macroeconomic projections.

The document painted a clear picture for those who can read between the lines. The updated forecasts showed policymakers upgraded their view on real Gross Domestic Product (GDP) for 2024 from 1.4% in December to 2.1%. However, inflation was also upwardly revised, with the core Personal Consumption Expenditures (PCE) Price Index now foreseen at 2.6% from 2.4% previously. Finally, the Unemployment Rate for 2024 was lowered from 4.1% to 4.0%.

Regarding rate cuts, the SEP showed the same as in December: three rate cuts are likely this year, with a median federal funds rate of 4.6% in 2024, implying three cuts of 25 basis points (bps) each. However, the median projection for the Fed Funds rate in 2025 rose to 3.9% from 3.6%, suggesting one less cut. The long-run projection for that benchmark rate ticked up as well, to 2.6% from 2.5%.

Ahead of the announcement, financial markets dialed back rate cut projections amid hotter-than-anticipated inflation in the first two months of the year. However, Chairman Jerome Powell cooled down such fears, saying seasonal effects could be behind the increase. Furthermore, he downplayed concerns about a tight labor market: “In and of itself, strong jobs growth is not a reason for us to be concerned about inflation,” he said.

The Fed basically said risks to the economy have decreased, spooking fears of a recession, and signaled multiple rate cuts are coming despite inflation upward surprises. The news propelled Wall Street into record territory, initially harming the US Dollar. However, and after the dust settled, the Greenback resurged on the back of encouraging US data indicating a resilient economy.

The country reported that Initial Jobless Claims for the week ended March 15 declined to 210K, beating expectations. Also, the Philadelphia Fed Manufacturing Survey printed at 3.2 in March, below the previous 5.2 but better than the expected -2.3. Finally, S&P Global unveiled the preliminary estimates of the March Purchasing Manager Indexes (PMIs), which confirmed the economic health. The manufacturing index improved to 52.5 from 52.2 in February, while the Services PMI slid to 51.7 from the previous 52.3. As a result, the S&P Composite PMI printed at 52.2, slightly below the previous 52.5, but overall indicating expansion.

Across the pond, the European Central Bank (ECB) continued to pave the way for a June rate cut. Multiple ECB officials said the likelihood of a June rate cut in Europe remains alive and kicking, although the most conservative clarified that it would depend on macroeconomic data. President Christine Lagarde hit the wires on Friday and repeated that policymakers expect inflation to continue easing in the upcoming months, adding growth is projected to pick up. Her words were not actually a surprise and barely helped the battered Euro.

Meanwhile, data from the Eurozone fell short of expectations and added to the Euro weakness. Mid-week, the Hamburg Commercial Bank (HCOB) flash Producer Manager Indexes (PMIs) estimates showed the economic downturn eased modestly in March, although the economy remains in contraction territory. EU figures showed a downtick in services output and a modest improvement in the manufacturing index, resulting in the EU Composite PMI printing at 49.9, higher than the previous 49.2 and just below the 50 line that indicates economic expansion.

On a positive note, sentiment seems to have improved in the Union. Germany published the March ZEW Survey, which showed that Economic Sentiment improved in the country and the overall EU, while the assessment of the current situation recovered modestly. Also, the IFO Business Climate survey for the same month jumped from 85.7 to 87.8, beating expectations.

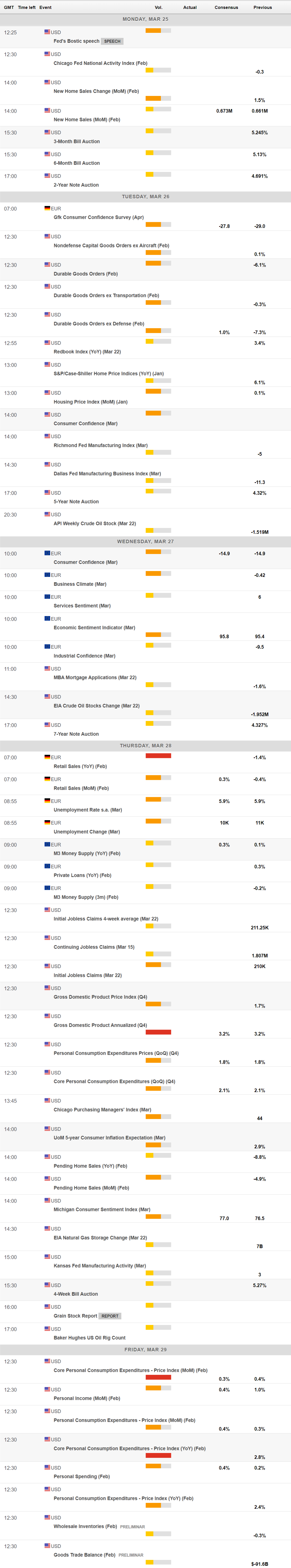

The upcoming week will be shortened due to Easter Holidays. However, the US will release several relevant figures, including February Durable Goods Orders and the final estimate of the Q4 GDP. Finally, on Friday, the country will unveil PCE inflation figures. The core PCE Price Index is foreseen at 0.3% MoM and 2.8% YoY, the latter matching January’s reading. The figures will likely weigh on the odds for a June rate cut, currently at 62%, according to the CME FedWatch Tool.

Across the pond, the calendar will be lighter. Germany will release the April GfK Consumer Confidence Survey, while the EU will publish March Consumer Confidence according to the European Commission estimates.

The EUR/USD pair bounced modestly after nearing 1.0804, the 61.8% Fibonacci retracement of the latest daily run, measured between 1.0694 and 1.0981. The 50% retracement provides resistance at 1.0871. According to the weekly chart, EUR/USD may extend its slide. The pair broke below a now flat 20 Simple Moving Average (SMA), while the 100 SMA maintains a modest bearish slope over 200 pips below the current level. Finally, technical indicators gain downward traction within bearish territory, supporting fresh lows ahead.

Technical readings in the daily chart support another leg lower as technical indicators crossed their midlines into negative territory, maintaining firmly bearish slopes. At the same time, EUR/USD is developing below all its moving averages, which have lost their bullish slopes. The 200 SMA converges with the aforementioned 50% Fibonacci retracement, reinforcing the resistance area.

The 1.0790-1.0800 region provides immediate support, with a break below it exposing the 1.0694 low. Once below the latter, the decline could extend towards the 1.0520 price zone, the 161.8% Fibonacci extension of the aforementioned rally. Resistance beyond the 1.0870 level could be found at 1.0940 and 1.1000.