- The Pound Sterling corrected from seven-month highs against the US Dollar.

- GBP/USD is likely to take further cues from the upcoming Fed and BoE policy announcements.

- GBP/USD needs to defend strong support near 1.2700 to negate the recent bearish bias.

The Pound Sterling (GBP) gave into the US Dollar (USD) resurgence, as GBP/USD registered a sharp correction from seven-month highs of 1.2894 reached a week ago.

Pound Sterling suffers on renewed USD demand

The US Dollar jumped back on the bids, mainly underpinned by less dovish US Federal Reserve (Fed) policy expectations. Traders pared bets for a June interest rate cut by the Fed following the release of the inflation data from the United States (US).

Data on Tuesday showed that the US Consumer Price Index (CPI) rose 3.2% in February from a year ago, beating the market forecast of 3.1%. The monthly CPI increased 0.4% in the same period. Core CPI, which excludes food and energy prices, increased 0.4% from the last month and 3.8% over the year.

Meanwhile, the US Producer Price Index (PPI) report released on Thursday showed an increase of 0.6% MoM in February, up sharply from 0.3% in January while beating the market estimate of 0.3%. The reading was the highest rate since August 2023. The PPI increased at an annual rate of 1.6%, up from a revised 0.9% in January. The PPI, which measures price changes at factory gates, is widely considered a leading indicator for consumer inflation as producers tend to pass on price increases to customers.

Markets ignored a weak US Retail Sales report, as hot PPI inflation data drove the sentiment around the US Dollar. Traders now see odds of a June Fed rate cut at 62%, down from about 75% a week ago, according to the CME Group’s FedWatch Tool.

The revival of the buying interest in the US Dollar added extra legs to the GBP/USD correction, as the pair tested weekly lows just above the 1.2700 level.

A weak UK labor market report also contributed to the pullback in the Cable. The UK ILO Unemployment Rate rose to 3.9% in three months to January, a tad higher than the 3.8% in December, data published by the Office for National Statistics (ONS) showed Tuesday. Average Earnings excluding Bonus, a measure of wage inflation, rose 6.1% 3M YoY in January versus December’s 6.2% increase, below the expected 6.2% raise. The UK pay growth was at its slowest pace since October 2022, which prompted markets to ramp up bets on a BoE rate cut in June, although one is not fully priced until August.

On Tuesday, a mixed message from the Bank of England (BoE) Governor Andrew Bailey also failed to support the Pound Sterling. Bailey said inflation expectations seemed to be under control and worries about a price-wage spiral were easing. He added that problems with labor market data and geopolitical risks left him unsure about the jobless rate, per Reuters.

The Consumer Sentiment Index in the US edged slightly lower to 76.5 in March from 76.9, the University of Michigan reported on Friday. This data, however, failed to trigger a noticeable market reaction and allowed GBP/USD to remain within its daily range below 1.2800 heading into the weekend.

Fed and BoE policy announcements in the spotlight

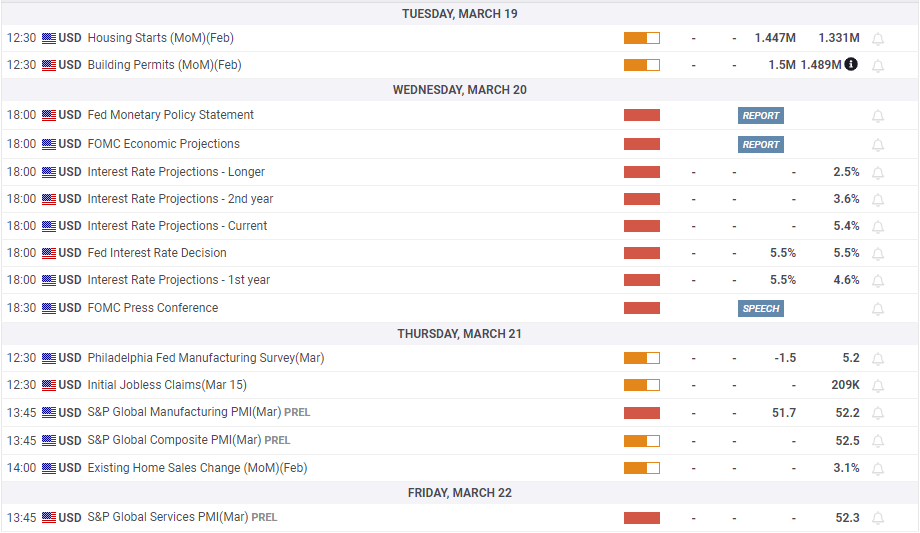

Heading into a big week, Pound Sterling traders gear up for some volatility, with the BoE and the Fed policy decisions.

Any hints on the timing and the scope of interest rate cuts from both central banks will trigger a big reaction in the GBP/USD pair, as an extended pause is fully baked in.

Also in focus will be the UK CPI inflation report due on Wednesday, while preliminary business PMIs from both sides of the Atlantic will be featured on Thursday.

Friday will see the release of the UK Retail Sales data and the return of Fed policymakers after the “blackout period”.

GBP/USD: Technical Outlook

As observed on the daily chart, GBP/USD is falling toward the rising channel support at 1.2655 after facing rejection at the channel upside barrier, back then at 1.2890.

The Pound Sterling needs to defend strong support near 1.2700 to negate the ongoing bearish momentum. That level is where the 21- and 50-day Simple Moving Averages (SMA) close in.

If a failure to do so, sellers will regain control and extend the downtrend to the abovementioned channel support at 1.2655.

A sustained break of that level will trigger a fresh drop toward the 100-day SMA at 1.2614, with the next critical cushion seen at the 200-day SMA at 1.2592.

However, the 14-day Relative Strength Index (RSI) still holds above the midline, despite this week’s decline. This suggests that GBP/USD could see some bargain-hunting demand on every move lower.

Adding credence to the bullish potential, a couple of Bull Cross remains in play.

If buyers manage to stage a comeback, GBP/USD could meet the first topside hurdle near 1.2820, above which a fresh advance toward the 1.2900 level will be in the offing.

Further up, the pair would then target the 1.3000 psychological level.