- ONDO is up 15% on Monday as RWA narrative expands in crypto market.

- Singapore-based DigiFT launches RWA tokens that offer direct claims to US Treasury bills.

- Attacker mints 1 billion Curio governance tokens in $16 million attack.

Ondo Finance (ONDO) is leading the real-world assets (RWA) category in an impressive rally that has seen its market capitalization increase by 17.1% in the last 24 hours. However, increased attention in the sector has attracted bad actors, and Curio Invest suffered a smart contract exploit.

RWA narrative continues momentum

ONDO has posted significant gains of about 90% in the past week, rising by about 15% in the last 24 hours. Beyond ONDO, the entire real-world assets category has been on an impressive rise with several tokens increasing steadily. For example, Centrifuge and Polymesh have seen weekly gains of 54.8% and 85.8%, respectively.

ONDO/USDT 1-hour chart

The RWA rally follows BlackRock’s announcement of launching its BlackRock USD Institutional Digital Liquidity Fund (BUIDL) on Ethereum. The news kick-started conversations in the crypto community around RWA tokens and how they might go on a massive rally similar to the earlier meme coin boom.

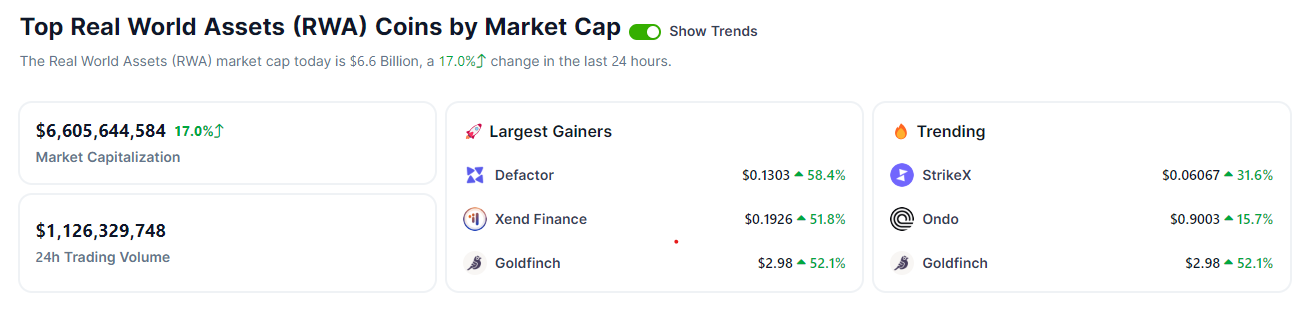

In a crypto market where narrative investing plays a crucial role, the market has bought the signals after the steady rise of the RWA market capitalization to $6.6 billion on Monday, according to CoinGecko.

RWA market capitalization

Read more: Polymesh up nearly 80% after BlackRock’s tokenized asset fund announcement

Other players want in on RWA action

Riding on the narrative, players in the RWA sector are beginning to make bold moves, as some crypto analysts predicted earlier in the year.

Singapore-based RWA exchange DigiFT recently launched an RWA token that’s based on US Treasury bills. According to the announcement on its website, the structure of the tokens would allow “investors to legally lay claim to and directly benefit from the economic returns generated by the underlying assets.”

Henry Zhang, CEO of DigiFT, said, “Looking ahead, DigiFT remains committed to expanding the universe of traditional financial assets in the Web3 space through the DR model, offering better investor protection and transparency.”

DigiFT is just one of several companies making the RWA move. Ava Labs also announced a recent collaboration between Chainlink (LINK) and Australia and New Zealand Banking Group (ANZ) aimed at the global movement and settlement of tokenized assets across Ethereum (ETH) and Avalanche (AVAX).

The collaboration’s focus was “to demonstrate how clients could access, trade, and seamlessly settle tokenized assets across networks in different currencies in a process called Delivery vs. Payment (DvP).” This aligns with a SWIFT report of 97% of institutional investors stating that tokenization can revolutionize the asset management industry.

Also read: AI, RWA: Two token classes to watch next after meme coin and staking market drive rally

More RWA attacks may follow increased attention in the sector

However, recent happenings aren’t all positive for RWA tokens. Curio Invest, a platform that aims to provide liquidity infrastructure for tokenized RWAs, suffered a $16 million attack on Sunday. The attacker appears to have exploited a “permission access logic vulnerability” in a smart contract based on MakerDAO that allowed them to mint 1 billion Curio governance tokens (CGT) as reported by Cyvers Alerts.

With more attention potentially given to RWA tokens in the coming days, it would be interesting to see how the narrative plays out.