Stock prices accelerated their uptrend yesterday, led by Nvidia which gained over 16% after Wednesday’s earnings release. The S&P 500 reached a new record high of 5,094.39, gaining 2.11%, while the Nasdaq 100 closed above the 18,000 level for the first time, though it failed to reach a new record high.

Recently, the stock market continued to rally, fueled by advances in a handful of tech sector stocks, but as I wrote on February 7, “We may have to deal with a correction or consolidation of several weeks of advances. With the season of quarterly earnings announcements coming to an end and a series of important economic data, profit taking may follow.” Despite yesterday’s rally, this still holds true. Nevertheless, rising volatility complicates short-term market predictions.

This morning, the market is relatively quiet, with the S&P 500 futures contract trading mostly unchanged. While the S&P 500 may pause today, an intraday correction remains a possibility.

The investor sentiment has improved a bit this week; Wednesday’s AAII Investor Sentiment Survey showed that 44.3% of individual investors are bullish, while 26.2% of them are bearish. The AAII sentiment is a contrary indicator in the sense that highly bullish readings may suggest excessive complacency and a lack of fear in the market. Conversely, bearish readings are favorable for market upturns.

The S&P 500 rallied above its previous highs yesterday, which negated all short-term bearish signals. However, the market is becoming more and more overbought again. The index remains above a month-long upward trend line, as we can see on the daily chart.

Nasdaq 100 – Almost new record

Last Monday, the technology-focused Nasdaq 100 index reached a new all-time high at 18,041.45, but by Tuesday, it sold off below the 17,500 level. In the subsequent days, it began retracing the decline. Despite rallying after Nvidia’s quarterly earnings announcement yesterday, the index failed to reach a new record high.

After Wednesday’s market close, Nvidia released its quarterly report, which was better-than-expected, and significant for the hot AI sector. This news triggered a substantial rally and marked a record increase in market capitalization for Nvidia, a company nearing the $2 trillion mark. Today, Nvidia’s stock is expected to open above the $800 price mark.

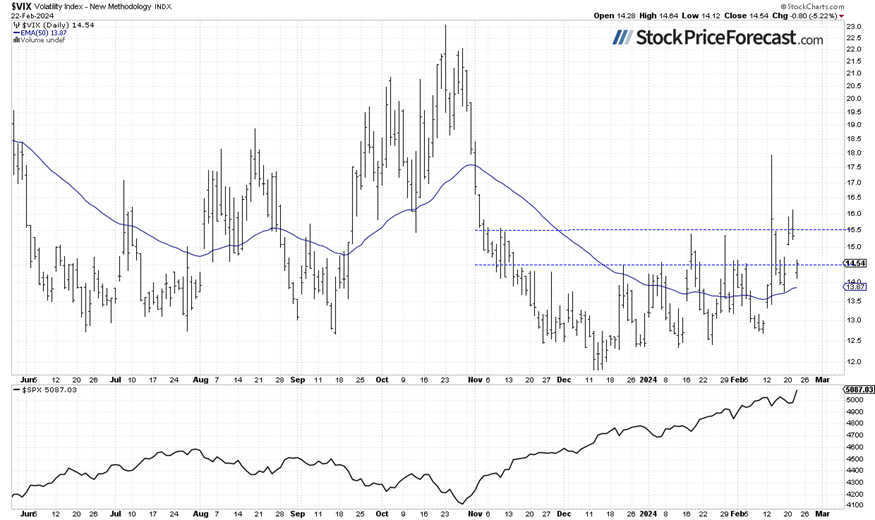

VIX remains above 14

The VIX index, also known as the fear gauge, is derived from option prices. Yesterday, it came back closer to the 14 level as stocks rallied. Nonetheless, it is still notably above its recent lows from November to February, indicating that the market fears a downward correction at some point.

Historically, a dropping VIX indicates less fear in the market, and rising VIX accompanies stock market downturns. However, the lower the VIX, the higher the probability of the market’s downward reversal.

Futures contract is at new record

Let’s take a look at the hourly chart of the S&P 500 futures contract. The market broke above the recent local highs yesterday, and this morning it’s trading along the 5,100 level. The support level is now at 5,060, marked by the recent highs.

Conclusion

The recent trading action was very bullish, with some of the tech stocks rallying to new record highs, the S&P 500 index breaking above 5,000, and the Nasdaq 100 index getting close to 18,000. In my last Tuesday’s analysis, I noted that, “in the short term, the possibility of a downward correction cannot be overlooked. A quick glance at the chart reveals that the S&P 500 index has recently become more volatile.”. Indeed, the correction occurred pretty fast, with the inflation number contributing to the downturn. However, the market quickly retraced the decline in the following days, and yesterday, it rallied to a new record high on Nvidia news.

The S&P is likely to open 0.1% higher, at another new record high and close to the 5,100 level. However, it may experience an intraday downward correction or consolidation at some point. The most likely scenario is an extended consolidation, as not all stocks are participating in the rally, and it’s driven by a handful of AI-connected ones.

For now, my short-term outlook remains neutral.

Here’s the breakdown

-

The S&P 500 is likely to reach a new record high this morning, slightly extending yesterday’s rally.

-

A longer consolidation phase may ensue, following an extended rally over the past months.

-

In my opinion, the short-term outlook is neutral.

Want free follow-ups to the above article and details not available to 99%+ investors? Sign up to our free newsletter today!