- Gold struggled to find direction as markets assessed geopolitical developments this week.

- The near-term technical outlook suggests that the bullish bias remains intact.

- Investors will scrutinize economic growth and inflation data from the US next week.

Gold (XAU/USD) price fluctuated in a relatively narrow range this week following the record-setting rally. Investors will continue to pay close attention to headlines surrounding the Iran-Israel conflict and scrutinize key macroeconomic data releases from the US next week.

Gold retreated after spiking above $2,400

Gold benefited from safe-haven flows and gathered bullish momentum at the beginning of the week as markets reacted to news of Iran launching an assault over the weekend, with dozens of drones and missiles in retaliation to the suspected Israeli attack on Iran’s consulate in Damascus on April 1. Gold gained more than 1.5% on Monday and registered its highest daily close on record. Meanwhile, the data from the US showed that Retail Sales rose 0.7% on a monthly basis in March. This reading came in better than the market expectation for an increase of 0.3% but XAU/USD ignored the renewed US Dollar (USD) strength.

As Western nations called upon Israel to avoid a further escalation of the conflict and reported plans of widening sanctions against Iran, market mood improved slightly on Tuesday and made it difficult for Gold to build on Monday’s gains. Meanwhile, hawkish comments from Federal Reserve (Fed) officials lifted the benchmark 10-year US Treasury bond yield to its highest level since early November, near 4.7%, and didn’t allow XAU/USD to gain traction.

Fed Chairman Jerome Powell said that the recent data indicated a lack of significant progress on inflation this year and added that they can maintain the current rate as long as needed if higher inflation were to persist. Additionally, San Francisco Fed President Mary Daly said that they need to be confident that inflation is on its way to the 2% target before taking a policy action. “The worst thing to do is act urgently when urgency isn’t necessary,” Daly argued.

In the absence of high-tier data releases, Gold staged a downward correction and closed in negative territory on Wednesday. As markets turned subdued on Thursday, XAU/USD struggled to find direction and ended the day little changed.

In the early trading hours of the Asian session on Friday, reports of Israeli missiles striking Iran triggered a flight to safety. With the knee-jerk reaction, Gold spike above $2,400. Although Israel did not immediately confirm a retaliatory attack against Iran, several news outlets said Israel carried out the strikes, citing US officials.

Following this development, however, the market mood improved on easing concerns over a further escalation of the conflict. A senior Iranian official told Reuters that there was no plan for an immediate retaliation because there was no clarification on who was behind the incident, while CNN reported that a regional intelligence source told the outlet that direct state-to-state strikes between Israel and Iran were over. In turn, Gold retreated below $2,400 and retraced its daily advance.

Gold investors await key US data

Market participants will stay focused on geopolitics next week. A de-escalation of the Iran-Israel crisis could trigger a downward correction in XAU/USD and cause the market focus to shift to the US data. On the other hand, another retaliatory response by Iran could revive fears over a deepening crisis in the Middle East and allow Gold to continue to capitalize on safe-haven demand.

On Thursday, the US Bureau of Economic Analysis (BEA) will release the Advanced Gross Domestic Product (GDP) data for the first quarter. In case the US economy posts a stronger-than-forecast annualized growth, the USD could hold its ground and weigh on XAU/USD. Since the beginning of April, Gold has been ignoring rising US yields and the broad USD strength. If geopolitics finally move to the back burner, Gold could come under bearish pressure, with investors adjusting their positions to growing expectations for a Fed policy hold in June. According to the CME FedWatch Tool, there is a less than 20% chance the Fed will lower the policy rate by 25 basis points in June.

On Friday, the BEA will publish the Personal Consumption Expenditures (PCE) Price Index data, the Fed’s preferred gauge of inflation, for March. Thursday’s GDP report will include the PCE Price Index data for the first quarter. Hence, Friday’s PCE reading will not offer any surprises and is unlikely to trigger a market reaction. Moreover, Fed Chairman Powell said that the annual core PCE inflation was little changed in March, according to their estimates.

Gold technical outlook

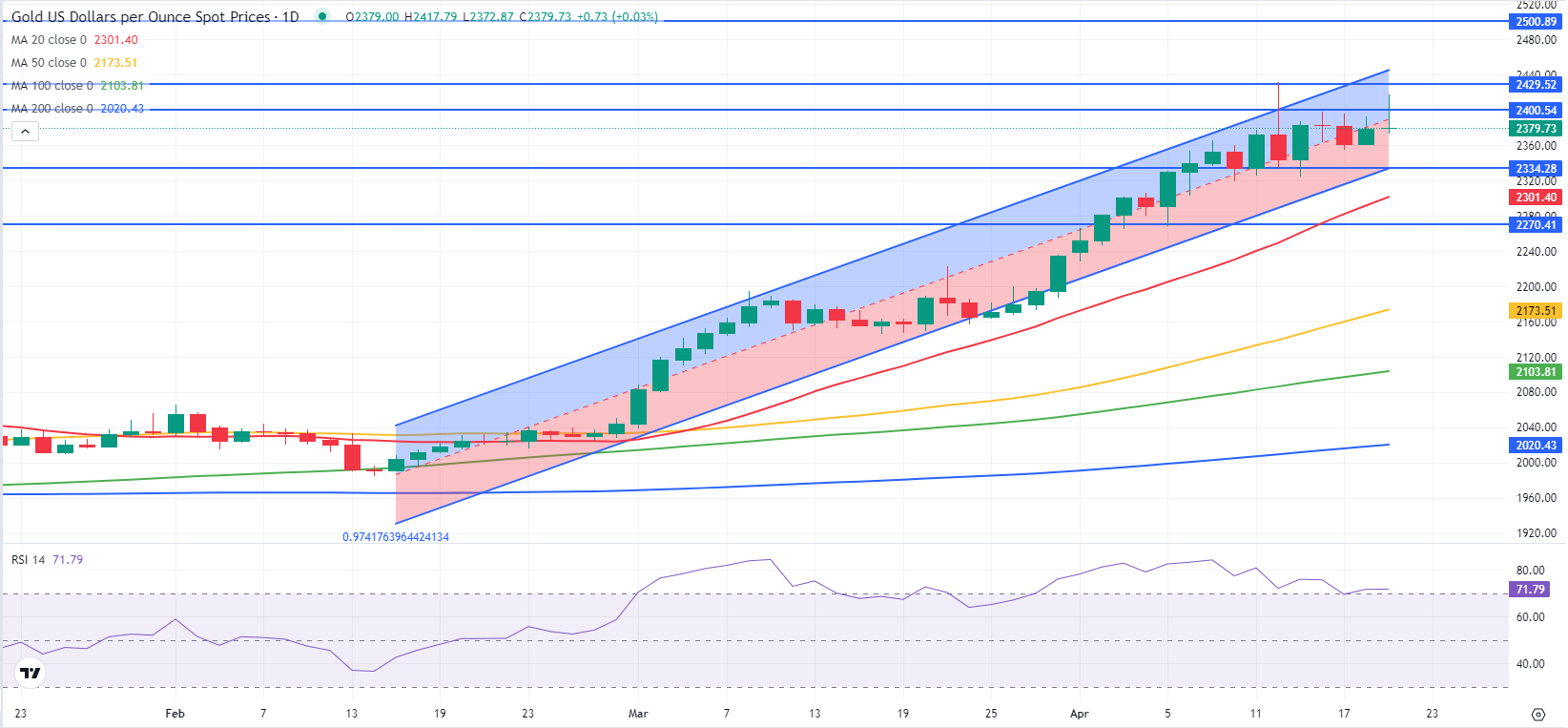

The Relative Strength Index (RSI) indicator on the daily chart retreated this week but it has yet to drop below 70 to signal the beginning of an extended downward correction. On the downside, the lower limit of the ascending channel from mid-February aligns as first support at $2,335. In case XAU/USD drops below this level and starts using it as resistance, additional losses toward $2,300 (20-day Simple Moving Average) and $2,270 (static level) could be seen.

Resistances are located at $2,400 (psychological level, static level), $2,430 (static level) and $2,500 (psychological level).

US Dollar FAQs

The US Dollar (USD) is the official currency of the United States of America, and the ‘de facto’ currency of a significant number of other countries where it is found in circulation alongside local notes. It is the most heavily traded currency in the world, accounting for over 88% of all global foreign exchange turnover, or an average of $6.6 trillion in transactions per day, according to data from 2022. Following the second world war, the USD took over from the British Pound as the world’s reserve currency. For most of its history, the US Dollar was backed by Gold, until the Bretton Woods Agreement in 1971 when the Gold Standard went away.

The most important single factor impacting on the value of the US Dollar is monetary policy, which is shaped by the Federal Reserve (Fed). The Fed has two mandates: to achieve price stability (control inflation) and foster full employment. Its primary tool to achieve these two goals is by adjusting interest rates. When prices are rising too quickly and inflation is above the Fed’s 2% target, the Fed will raise rates, which helps the USD value. When inflation falls below 2% or the Unemployment Rate is too high, the Fed may lower interest rates, which weighs on the Greenback.

In extreme situations, the Federal Reserve can also print more Dollars and enact quantitative easing (QE). QE is the process by which the Fed substantially increases the flow of credit in a stuck financial system. It is a non-standard policy measure used when credit has dried up because banks will not lend to each other (out of the fear of counterparty default). It is a last resort when simply lowering interest rates is unlikely to achieve the necessary result. It was the Fed’s weapon of choice to combat the credit crunch that occurred during the Great Financial Crisis in 2008. It involves the Fed printing more Dollars and using them to buy US government bonds predominantly from financial institutions. QE usually leads to a weaker US Dollar.

Quantitative tightening (QT) is the reverse process whereby the Federal Reserve stops buying bonds from financial institutions and does not reinvest the principal from the bonds it holds maturing in new purchases. It is usually positive for the US Dollar.