Watch the video extracted from the WLGC session before the market open on 5 Mar 2024 below to find out the following:

-

What does a rising wedge mean (in price action)?

-

The ultimate defense for the S&P 500 to watch out for when there is a breakdown from the rising wedge pattern

-

The sudden market reversal scenario traders to pay attention to in these overbought conditions.

-

The trading strategies to adopt should traders want to get exposure.

-

and a lot more…

Market environment

The bullish vs. bearish setup is 767 to 71 from the screenshot of my stock screener below.

Wyckoff method stock screener.

Market comment

The exhaustion of the up momentum is reflected in the rising wedge pattern.

Traders need to watch out for the ultimate key level illustrated in the video that could trigger a meaningful correction closely.

Volatility should pick up and a market rotation into the small and mid-cap stocks as discussed in the live session is a favorable bullish scenario we anticipate, which is healthy for a sustainable rally.

There are a lot of post-earning setups as discussed in the premium video below that will give you immediate feedback regarding the current market condition.

A failure or no trigger should put you in the defensive seat.

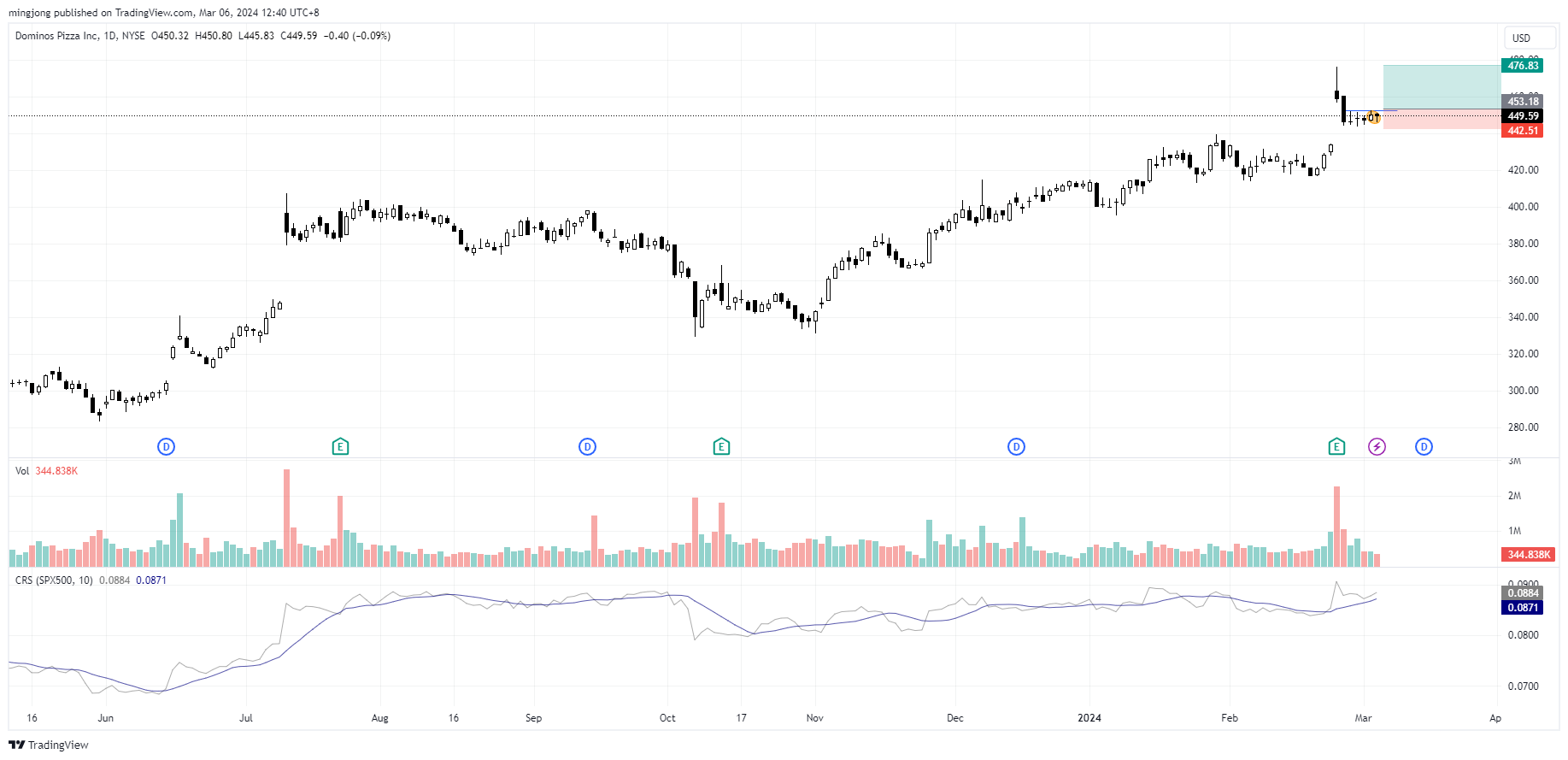

9 “low-hanging fruits” (DPZ, FAS, etc…) trade entries setup + 14 actionable setups (CG etc…) plus 4 “wait and hold” candidates are discussed in the video (39:32) below the paywall accessed by subscribing members.

DPZ

FAS

CG