Activity in the industrial sector continued at the stall speed in January that characterized 2023. Manufacturing activity slipped by the most in three months, demonstrating that even as rate cuts are on the horizon, current production remains constrained.

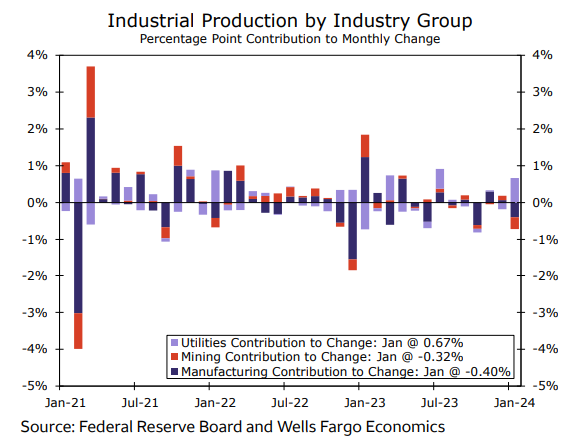

The stall speed of industrial sector activity that characterized 2023 continued in January, with total industrial production down 0.1% during the month (chart). Weakness was primarily due to a 0.5% drop, or the largest in three months, in manufacturing output (chart). Manufacturing activity is a bulk of industrial production, accounting for about three quarters of the total, meaning it has a large bearing on total activity. But additional weakness also came from mining output (~15% of total IP), which slipped 2.3%. The big offset was in the small but mighty utilities component of IP (~10% of IP), which rebounded 6.0% in January after being down in three of the previous four months.

Manufacturing activity continues to be constrained by economic uncertainty and higher financing costs crimping capex investment (chart). January’s output was held back by a wide range of industries. Petroleum & coal products output dropped the most, down 3.7%, and five others also reported declines of 1% or greater with a notable 1.3% drop in chemicals production, which represents about 16% of all manufacturing output. On the other end of the spectrum, output in the electrical equipment & appliances and aerospace & miscellaneous transportation industries both rose 1.5%. The largest gain in output came from printing, up 1.6%. In short, activity was a bit more mixed than the total drop would suggest.

The slowdown in activity has helped cool inflation. Even as the ISM manufacturing index suggested some increased price pressure in January, there continues to be little sign of concern of a reacceleration in inflation coming from the manufacturing sector. Capacity utilization, a measure of how much of the industrial sector is being utilized, slipped to 78.5% in January, or the lowest since late 2021. In short, businesses are using their factories and workers less intensely. That’s an upshot for the Fed trying to tame inflation, but the situation warrants close monitoring because layoffs could ensue if demand for labor in the factory sector does not keep pace with the supply of labor.

But despite the weak outturn for January, there are some early signs that the industrial sector may be on the cusp of recovery, as recent data suggest activity may be turning a corner. Shipments and new orders for durable goods ticked up at the end of last year, and the ISM manufacturing index signaled the slowest pace of contraction in the sector in more than a year in January. Separately released regional manufacturing data this morning from the Federal Reserve Bank’s of New York and Philadelphia also suggested some improvement in February.

Uncertainty over the timing of rate cuts continues to be the biggest hurdle for manufacturers as it eats into businesses new capital spending plans. While recent inflation data may go against an imminent rate cut, the widespread expectation remains that the Fed’s next rate adjustment will be lower. It’s simply becoming a question of when and by how much, which will likely help support investment this year even if the recovery comes at a gradual pace.