- The Japanese Yen continues to be undermined by dovish BoJ remarks on Thursday.

- The Fed rate cut uncertainty keeps the USD bulls on the defensive and caps gains.

- Traders also prefer to wait for the US consumer inflation figures, due next week.

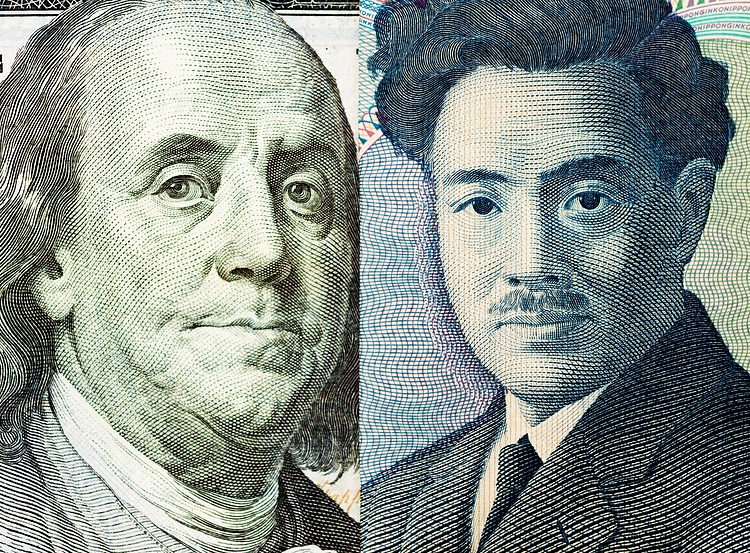

The Japanese Yen (JPY) remains on the back foot against its American counterpart on Friday and touches a fresh YTD low during the Asian session. The Bank of Japan (BoJ) Deputy Governor Uchida Shinichi’s dovish remarks on Thursday, saying that the central bank will not hike aggressively upon ending negative rates, along with a generally positive risk tone, continue to undermine the JPY. The US Dollar (USD), on the other hand, continues with its struggle to gain any meaningful traction in the wake of the uncertainty over the timing and the pace of interest rate cuts by the Federal Reserve (Fed). This, however, does little to provide any respite or impress the JPY bulls.

Market participants, meanwhile, seem convinced that another significant pay hike this year will pave the way for the BoJ to exit its decade-long ultra-loose monetary policy. Furthermore, traders might also prefer to wait for next week’s release of the US consumer inflation figures for cues about the Fed’s rate-cut path. This will play a key role in influencing the near-term USD price dynamics and provide a fresh directional impetus to the USD/JPY pair. Nevertheless, spot prices remain on track to register strong weekly gains in the absence of any relevant macro data from the US and the aforementioned fundamental backdrop seems tilted in favour of bullish traders.

- The Japanese Yen witnessed aggressive selling on Thursday and tumbled to a fresh YTD low against the US Dollar in reaction to Bank of Japan Deputy Governor Shinichi Uchida’s dovish remarks.

- In a press release, Uchida signalled a gradual move away from the current negative interest rate environment and said that the BoJ is not looking to make any drastic moves in the near future.

- Chief Cabinet Secretary Yoshimasa Hayashi said this Friday that it is up to the BoJ to decide monetary policy details and Uchida’s comments were the same as Governor Ueda made at the last meeting.

- Japanese Finance Minister Shunichi Suzuki said that specific monetary policy is up to the BoJ to decide and that it is important for currencies to move in a stable manner, reflecting fundamentals.

- Robust US macro data, along with the recent hawkish comments by several Federal Reserve officials, forced investors to scale back their expectations for early and steep interest rate cuts this year.

- Richmond Fed Thomas Barkin said on Thursday that the central bank has time to be patient on rate changes and that he needs to see good inflation numbers being sustained and broadening.

- Barkin further added that the labour market remains vibrant and it is hard to determine the appropriate course of action for rates based solely on economic models.

- The yield on the benchmark 10-year US government bond holds comfortably above 4.0%, though does little to impress the US Dollar bulls or provide any meaningful impetus to the USD/JPY pair.

- Traders now seem reluctant to place aggressive bets and prefer to wait for the release of next week’s US consumer inflation figures for fresh cues about the Fed’s future policy decision.

From a technical perspective, the overnight breakout through the 148.80 horizontal barrier was seen as a fresh trigger for bullish traders and might have already set the stage for additional gains. Moreover, oscillators on the daily chart are holding comfortably in the positive territory and are still away from being in the overbought zone. This further validates the constructive set-up and suggests that the path of least resistance for the USD/JPY pair is to the upside. Hence, a subsequent strength towards reclaiming the 150.00 psychological mark, for the first time since November 17, looks like a distinct possibility. Some follow-through buying should pave the way for an extension of the recent uptrend witnessed since the beginning of this year.

On the flip side, any meaningful corrective decline now seems to find decent support near the 149.00 mark ahead of the 148.80 strong resistance breakpoint. The latter should act as a key pivotal point, which if broken decisively might prompt some technical selling and drag the USD/JPY pair back to the 148.00 round figure. The downward trajectory could get extended further towards testing the 100-day Simple Moving Average (SMA), around the 147.60 region. Failure to defend the latter will negate the positive outlook and shift the near-term bias in favour of bearish traders.

Japanese Yen price today

The table below shows the percentage change of Japanese Yen (JPY) against listed major currencies today. Japanese Yen was the weakest against the New Zealand Dollar.

| USD | EUR | GBP | CAD | AUD | JPY | NZD | CHF | |

| USD | 0.00% | 0.00% | 0.01% | 0.06% | 0.00% | -0.24% | 0.01% | |

| EUR | 0.00% | 0.00% | 0.01% | 0.06% | 0.01% | -0.25% | 0.01% | |

| GBP | 0.00% | -0.01% | 0.02% | 0.06% | 0.01% | -0.24% | 0.02% | |

| CAD | -0.02% | -0.02% | -0.02% | 0.04% | -0.02% | -0.26% | 0.00% | |

| AUD | -0.06% | -0.07% | -0.06% | -0.05% | -0.06% | -0.30% | -0.03% | |

| JPY | -0.01% | -0.01% | 0.01% | 0.00% | 0.03% | -0.23% | 0.02% | |

| NZD | 0.24% | 0.23% | 0.23% | 0.24% | 0.29% | 0.24% | 0.25% | |

| CHF | -0.04% | -0.04% | -0.04% | -0.03% | 0.02% | -0.03% | -0.28% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Euro from the left column and move along the horizontal line to the Japanese Yen, the percentage change displayed in the box will represent EUR (base)/JPY (quote).

Bank of Japan FAQs

The Bank of Japan (BoJ) is the Japanese central bank, which sets monetary policy in the country. Its mandate is to issue banknotes and carry out currency and monetary control to ensure price stability, which means an inflation target of around 2%.

The Bank of Japan has embarked in an ultra-loose monetary policy since 2013 in order to stimulate the economy and fuel inflation amid a low-inflationary environment. The bank’s policy is based on Quantitative and Qualitative Easing (QQE), or printing notes to buy assets such as government or corporate bonds to provide liquidity. In 2016, the bank doubled down on its strategy and further loosened policy by first introducing negative interest rates and then directly controlling the yield of its 10-year government bonds.

The Bank’s massive stimulus has caused the Yen to depreciate against its main currency peers. This process has exacerbated more recently due to an increasing policy divergence between the Bank of Japan and other main central banks, which have opted to increase interest rates sharply to fight decades-high levels of inflation. The BoJ’s policy of holding down rates has led to a widening differential with other currencies, dragging down the value of the Yen.

A weaker Yen and the spike in global energy prices have led to an increase in Japanese inflation, which has exceeded the BoJ’s 2% target. Still, the Bank judges that the sustainable and stable achievement of the 2% target has not yet come in sight, so any sudden change in the current policy looks unlikely.