EUR/USD, “Euro vs US Dollar”

EUR/USD is rising within a bullish channel. The instrument is going above the Ichimoku Cloud, which suggests an uptrend. A test of the Tenkan-Sen line at 1.0880 is expected, followed by a rise to 1.0985. An additional signal confirming the rise might be a rebound from the lower boundary of the bullish channel. The scenario can be cancelled by a breakout of the lower boundary of the Cloud with the price finding a foothold under 1.0805, which will mean a further decline to 1.0705.

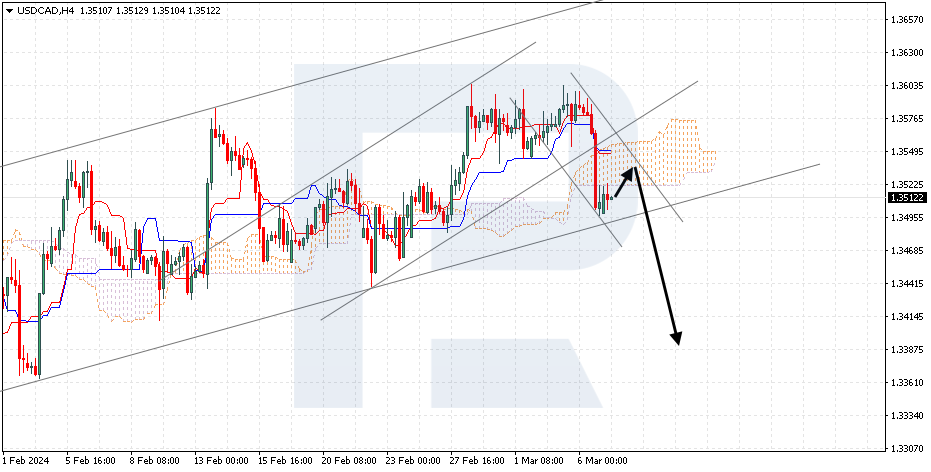

USD/CAD, “US Dollar vs Canadian Dollar”

USD/CAD is rebounding from the lower boundary of the bullish channel. The instrument is going below the Ichimoku Cloud, which suggests a downtrend. A test of the lower boundary of the Cloud at 1.3525 is expected, followed by a decline to 1.3385. An additional signal confirming the decline could be a rebound from the upper boundary of the bearish channel. The scenario can be cancelled by a breakout of the upper boundary of the Cloud with the price finding a foothold above 1.3585, which will mean further growth to 1.3675. Meanwhile, the decline could be confirmed by a breakout of the lower boundary of the ascending channel with the price finding a foothold under 1.3670.

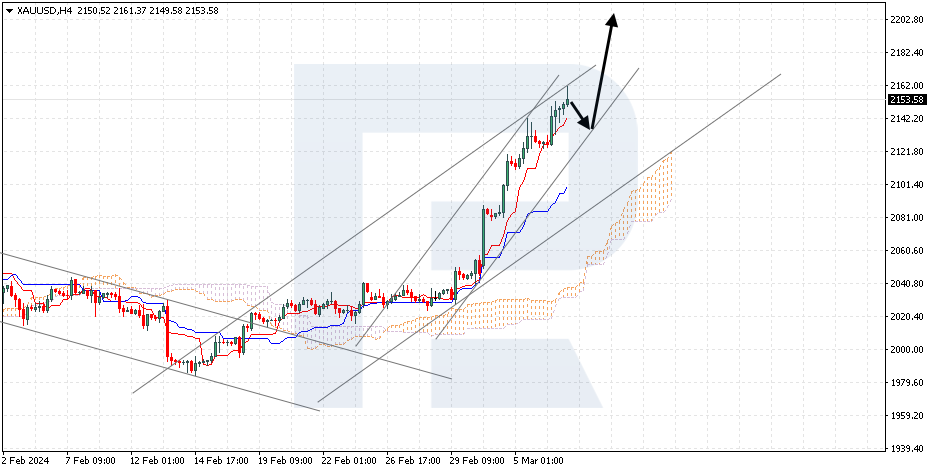

XAU/USD, “Gold vs US Dollar”

Gold is correcting after a rebound from the upper boundary of the bullish channel. The instrument is going above the Ichimoku Cloud, which suggests an uptrend. A test of the Tenkan-Sen line at 2140 is expected, followed by a rise to 2205. An additional signal confirming the rise might be a rebound from the lower boundary of the bullish channel. The scenario can be cancelled by a breakout of the lower boundary of the Cloud with the price finding a foothold under 2030, which will mean a further decline to 1990.