GBP/USD lost its traction and dropped below 1.2650 early Wednesday following Tuesday’s choppy action. The pair’s technical picture highlights a bearish tilt in the short term. The US Dollar (USD) found a foothold in the second half of the day on Tuesday as US Treasury bond yields edged higher and Wall Street’s main indexes failed to gather bullish momentum.

US stock index futures are down between 0.2% and 0.4% early Wednesday and the UK’s FTSE 100 Index is losing 0.3% in the early trade, highlighting a cautious market stance midweek. If US stocks push lower after the opening bell, the USD could benefit from risk-aversion and weigh on GBP/USD. Read more…

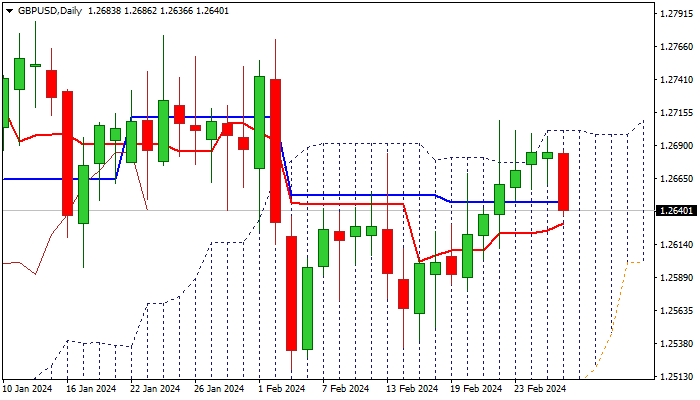

Cable dips 0.3% in Asian/early European trading on Wednesday after a multiple failures to clear the top of daily Ichimoku cloud. Long upper shadows on daily candles and narrowing ranges in past few sessions, confirmed significance of cloud top barrier, while diverging RSI added to early signals that bulls were running out of steam and warned of pullback.

Fresh bears cracked Fibo support at 1.2643 (38.2% of 1.2535/1.2709 upleg, reinforced by 10DMA), loss of which to signal further weakness and expose targets at 1.2600 (Fibo 61.8%) and 1.2570 (200DMA). Read more…

he GBP/USD pair comes under heavy selling pressure following the previous day’s two-way directionless price moves and drops to the 1.2665 region during the Asian session on Wednesday.

Despite Tuesday’s disappointing release of the US Durable Goods Orders, investors seem convinced that the Federal Reserve (Fed) will wait until the June policy meeting before cutting interest rates. This helps revive the US Dollar (USD) demand, which, in turn, is seen as a key factor exerting downward pressure on the GBP/USD pair. Read more…