- Middle East tensions continue to keep investors on the edge of their seats.

- US Retail Sales data will provide an updated snapshot of the health of the economy.

- Chinese GDP may confirm the narrative that Beijing’s stimulus is working.

- UK inflation data may push the Bank of England to early rate cuts.

- US Jobless Claims stand out in the week when the Nonfarm Payrolls survey is held.

Which central bank will be the next to cut interest rates? The Federal Reserve (Fed) is not high on the list, especially after the third consecutive hot inflation report. It was later backed by hawkish comments, but other central banks are moving toward the exit.

This week features five key events that will help answer that question – implying high volatility in currency markets.

Will Iran attack Israel over the weekend? The Wall Street Journal published an assessment saying that is the window for Tehran to launch a retaliation for the killing of a top general in Damascus last week.

With an ongoing war between Israel and Hamas in Gaza, and skirmishes with Hezbollah on Israel’s northern border, what could another front add? The answer is US involvement, especially if it affects Oil exports from the Persian Gulf.

US President Joe Biden said America’s commitment to defending Israel is ironclad, and he sent a top general to Israel for coordination. The sight of American warplanes attacking Iran from the Gulf would halt Oil shipments and deal a blow to the global economy.

How likely is such a scenario? Probably less than 50%. There are other scenarios in which Iran strikes Israel through proxies or in a limited fashion. Another possible outcome is that the leadership in Tehran waits for a better opportunity, when the other side is less prepared.

If nothing happens over the weekend, I expect a relief rally in markets, and a decline in Gold and Oil prices. A major war would send them shooting higher. I lean toward the optimistic scenario of no major escalation.

Monday, 12:30 GMT. Are higher prices taking a toll on consumption? The relentless American shopper has defied inflation and remains resilient. After an increase of 0.6% in headline retail sales in February, a more modest 0.3% advance is expected for March.

I anticipate an upside surprise this time. Why? In the past two months, Retail Sales missed estimates – but that came after six months of beats in a row. Economists may have adjusted for the recent shortcomings, now projecting only a modest increase.

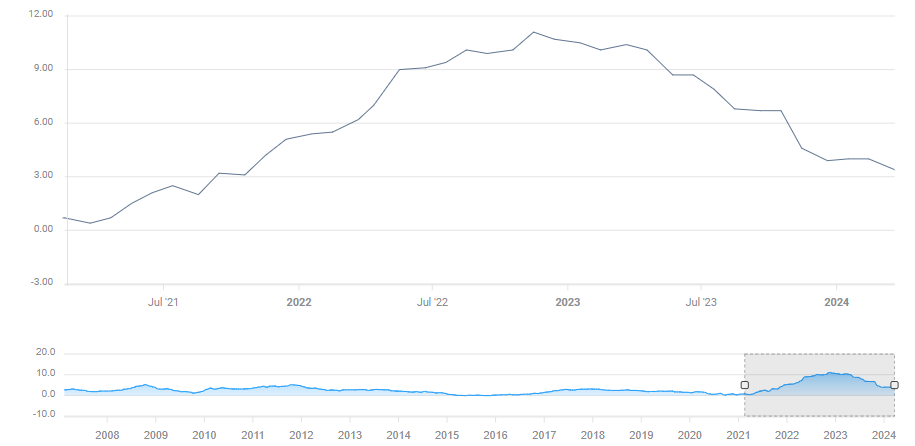

US Retail Sales. Source: FXStreet

It is essential to note that revisions are common in this release, and that they may skew the outcome. For example, a strong increase may come on top of a downward revision of the same size, taking the sting out of the increase. Markets tend to react to the most recent figure first, then later dive deeper, moving to the other direction.

Apart from headline Retail Sales, the Control Group is also of high importance. This core measure excludes volatile items such as food and energy purchases. Headline sales and the Control Group tend to go in the same direction, either both beating estimates or missing them.

Tuesday, 02:00 GMT. The world’s second-largest economy has not fully recovered from its long-lasting covid restrictions. These were lifted in late 2022, but a robust rebound has never been seen. On the other hand, Beijing has put efforts into specific sectors such as electric vehicles and Artificial Intelligence, and this may have given its economy a boost.

An annual increase of 5.0% is expected for the first quarter, slightly below the 5.2% recorded in the last quarter of 2023. I expect better data given recent efforts to shore up the economy.

Chinese GDP. Source: FXStreet

The Australian Dollar is the most sensitive currency to Chinese data, as the land Down Under heavily depends on exports to the Asian giant. Stock markets also need stronger growth data from China.

Oil, which has been rising in response to growing Middle East tensions, will likely also respond to any surprises in Chinese data.

Apart from GDP, Beijing also releases monthly Industrial Production and Retail Sales figures for March. Any surprises will also impact markets.

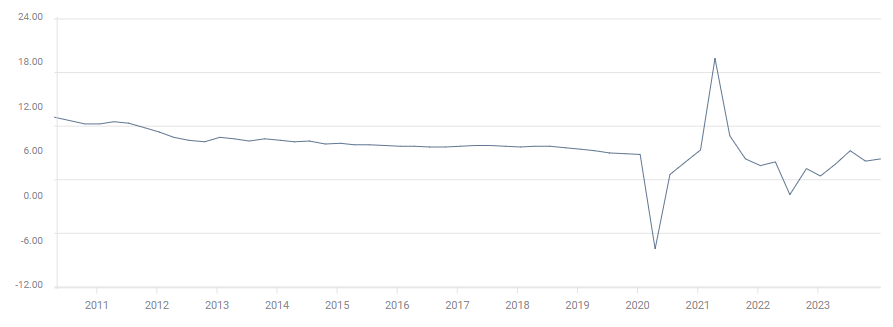

Wednesday, 06:00 GMT. Will the Bank of England cut rates in May? A drop in inflation from February’s 3.4% YoY read could raise expectations for such a move, when the BoE also releases new data.

The London-based institution’s interest rate is at 5.25%, and a drop of the headline Consumer Price Index (CPI) below 3% would undoubtedly serve as a trigger. Even a slide to 3.2%, which would put the real interest rate at 2%, would raise expectations for a cut as soon as the next meeting.

Weak UK inflation data may also add to pressures on the Euro, as the two economies are correlated – and perhaps also propel the US Dollar higher. The Federal Reserve will probably be the last central bank holding its ground.

UK inflation has fallen sharply from its double-digit peak:

UK CPI. Source: FXStreet.

Thursday, 12:30 GMT. Unemployment claims are published every week and they have been stable for long months. This time may be different, for two reasons.

First, the data is not overshadowed by major events such Nonfarm Payrolls or inflation. Second, the figures are for the week including the 12th, which is when the NFP surveys are held. Markets may pay more attention to the data.

The Fed is focused on inflation as it is still too high, while the labor market is solid. Any increase in jobless claims above 220K could trigger speculation that a rate cut could come earlier. A bigger upside surprise would be needed for the effect to last longer.

Even without top-tier market events, there is enough going on to trigger high volatility. Geopolitical news may happen at any moment.