Bitcoin (BTC) price shows no directional bias whatsoever as it trades inside a tight range. Investors, however, are looking at Ethereum (ETH), Ripple (XRP) and other altcoins for volatility.

Bitcoin price action over the past week shows that volatility is nowhere to be found. As BTC trades inside a $41-43,000 range, investors are anticipating a move in either direction. Some forecast that a crash to $34,000 needs to occur before the pioneer crypto rallies higher. Others are playing a contrarian approach, expecting BTC to continue its uptrend as it breaches the tightening range.

XRP price sustained above the psychologically important level of $0.50 even as payment giant Ripple requested to push the deadline for remedies-related discovery in the SEC lawsuit. The cross-border payment remittance firm seeks to push the deadline from February 12 to 20, according to a court filing.

Ripple is currently faced with two major obstacles, the ongoing SEC lawsuit and On-Demand Liquidity corridor’s utility and relevance in the US and Asia.

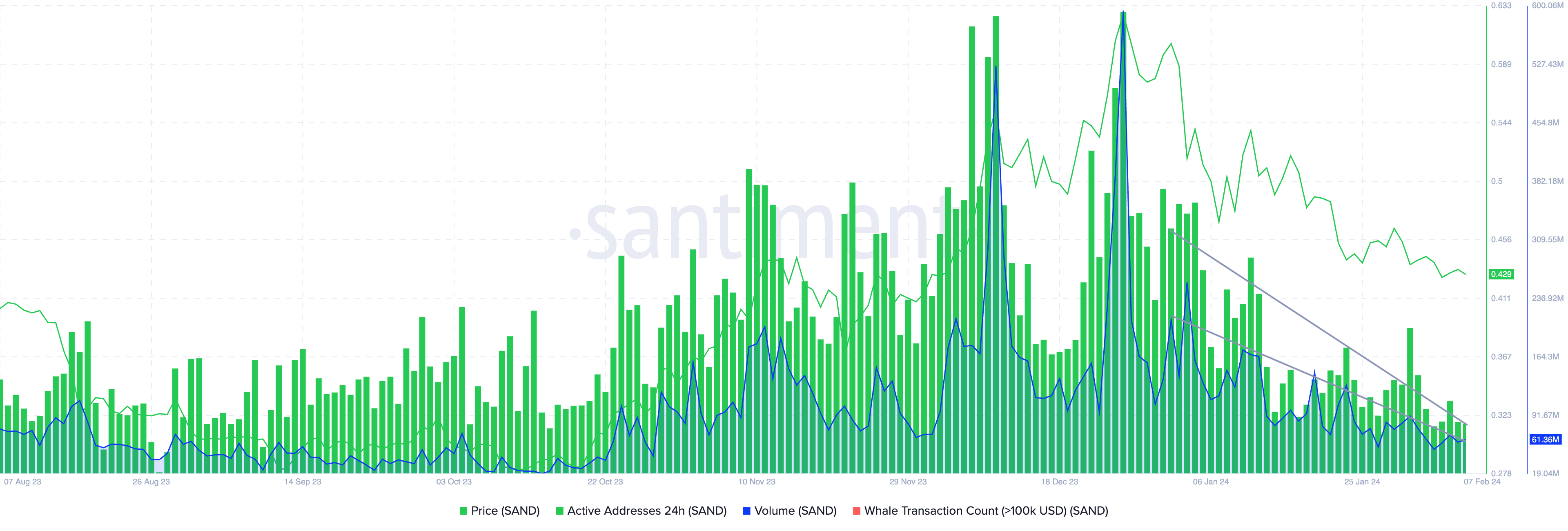

Sandbox has scheduled a $94.42 million unlock on February 14. The token is currently in a downward trend and further decline is likely with the likely release of 205.59 million tokens in SAND’s circulating supply.

On-chain metrics support a bearish thesis for SAND and further correction in the metaverse token is likely. Sandbox’s Active Addresses and Volume, two metrics used to determine user activity and the token’s demand among market participants, signal a correction in SAND. Since January 1, SAND’s Active Addresses and Volume have been in a downward trend, as seen in the Santiment chart below.