- Bitcoin and large-cap altcoins are yet to establish a clear direction despite upcoming halving hype.

- Santiment data shows AI & Big Data, Liquid Staking, and DeFi are among the most profitable categories in the crypto market.

- Santiment analysis shows that traders see recent Bitcoin correction as a buying opportunity.

The general crypto market has witnessed a steady decline in trading volume since March 6 according to data from Santiment. While Bitcoin and many large altcoins struggle to establish a clear direction, community members see the recent market correction as a buying opportunity.

Also read: Vitalik Buterin excludes L2 chains that do not use Ethereum for data availability at web3 carnival

Crypto trading volume plummets

Bitcoin skyrocketed to an all-time high of $73,737 on March 14 after experiencing increased buying pressure caused by the Bitcoin ETF approval in January. However, Bitcoin’s correction after reaching its all-time high has caused the market to stagnate.

Data from Santiment shows crypto trading volume has decreased steadily since March 6. While the meme coin boom of March sparked attention in the market, most of them were low-capped and couldn’t garner impressive volume.

Read more: Bitcoin halving is a few days away. Here’s what key crypto community members are saying

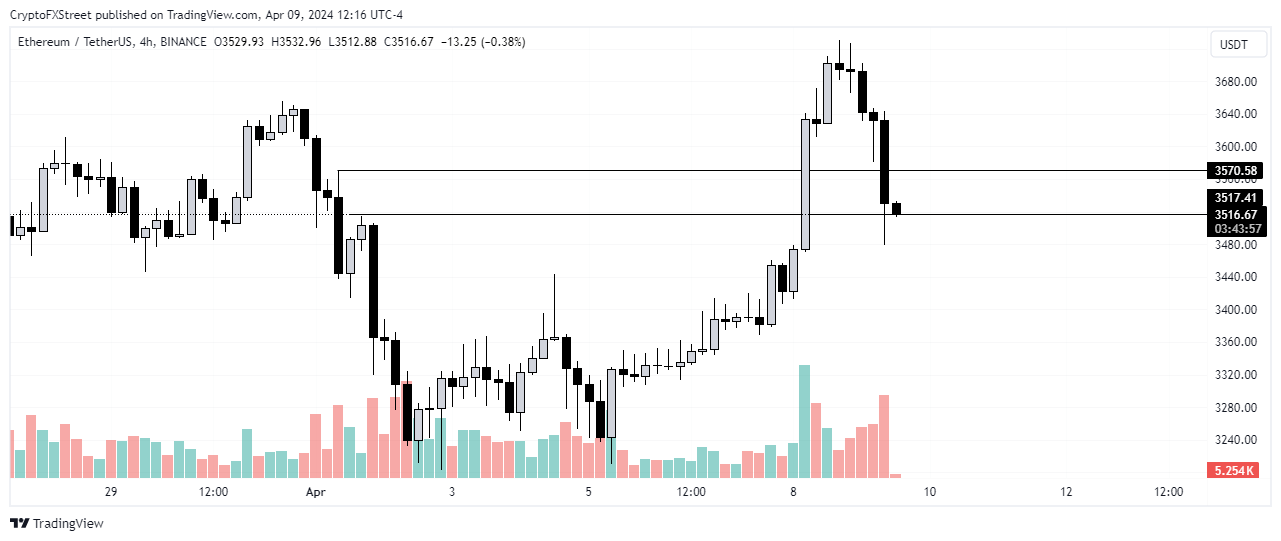

Crypto trading volume

Several top altcoins alongside Bitcoin have largely maintained a sideways movement indicating indecisiveness among traders. Despite the increasing social activity these coins have been receiving as Bitcoin halving approaches, investors may still be highly skeptical about which direction to take with their trades. Trading volume will begin to grow consistently once their price maintains a clear direction.

While the market correction indicates sell pressure, Santiment data indicates other traders may be buying the dip following increased usage of the #dipbuy and #halving in 10 days across crypto community members.

AI and Big Data category lead in gains

Another Santiment data also shows that AI and Big Data, Liquid Staking, and DeFi were among the top categories that posted impressive gains in the last 24 hours. Data from CoinGecko also shows that the Liquid Restaking category experienced gains of 6.6% on Tuesday despite the wider crypto market correction.

Also read: Fetch.ai, Ocean, and SingularityNET merger a step closer after proposal approval

The recent growth in the AI & Big Data category may have been caused by Fetch.ai’s community approving the three proposals for its underlying FET token to merge with Ocean Protocol (OCEAN) and SingularityNET (AGIX) to form the Artificial Super Intelligence (ASI).

In the case of Liquid Restaking, it may be due to their high yields and the recent launch of Eigenlayer on the Ethereum Mainnet.