Chainlink has observed an increase in address activity in the past week. This paved the way for LINK price to rally towards its 2024 high of $20.856 on Binance. LINK price is $20.294 on Wednesday, lingering close to its 2024 peak. On-chain metrics paint a bullish picture for Chainlink’s token.

Three key on-chain metrics, Active Addresses, Daily Active Addresses and Supply on Exchanges support LINK’s recent price gains. Active Addresses noted several spikes throughout February, as seen in the Santiment chart below. Active Addresses hit a high of 6,493 on February 2.

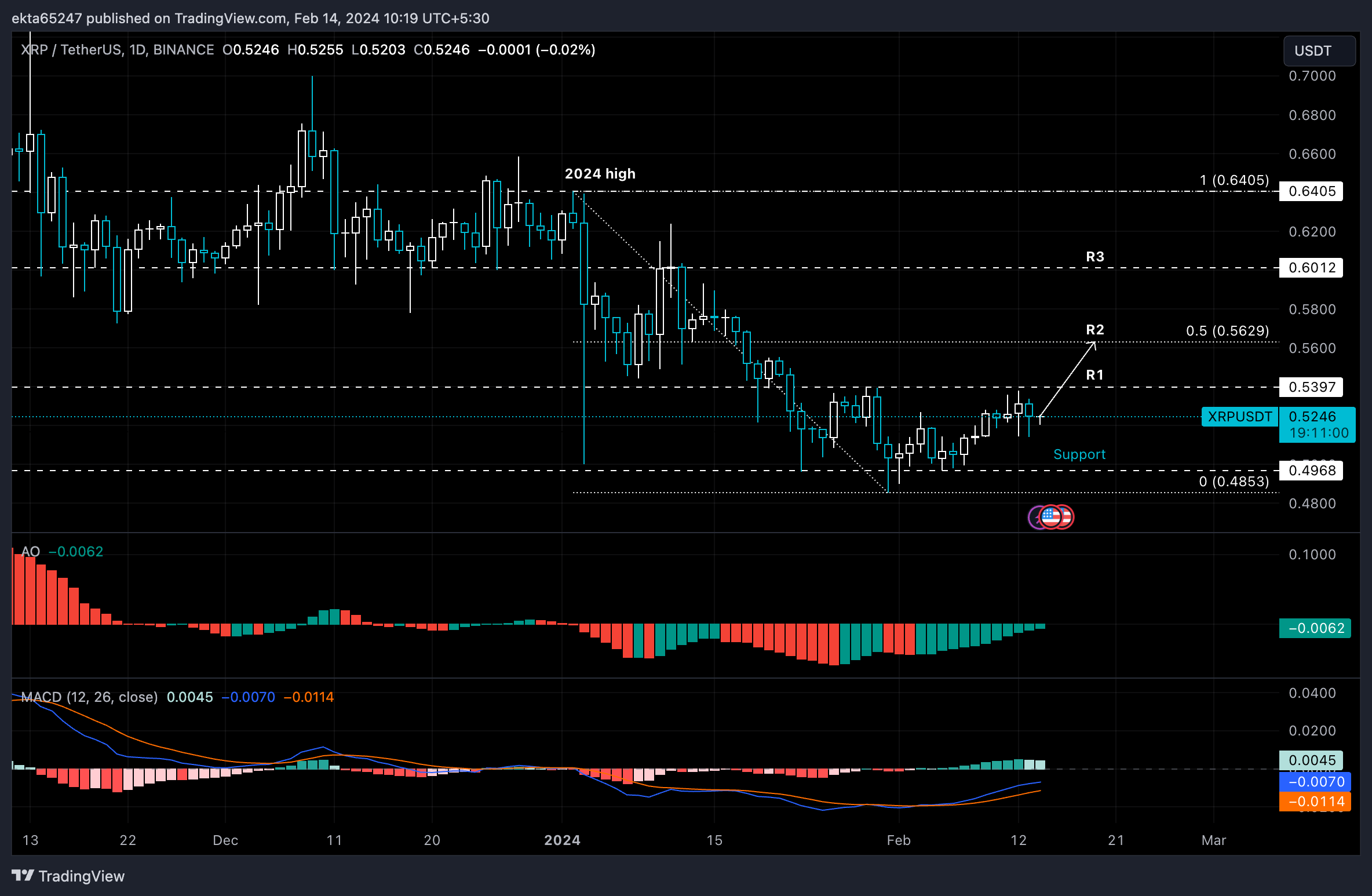

XRP price is trading sideways below the $0.53 level. The altcoin is struggling to tackle resistance on its path to its $0.56 target. The payment remittance firm’s CEO, Brad Garlinghouse, announced Ripple’s plan to foray into crypto custody with its recent acquisition of a New York trust charter firm.

While Ripple is embroiled in a legal battle with the US Securities and Exchange Commission (SEC), the firm has secured nearly 40 US money transmitter licenses, a Monetary Payments Institution license from the Monetary Authority of Singapore (MAS), and a Virtual Asset Service Provider registration with the Central Bank of Ireland.

MATIC, the native token of Ethereum’s largest scaling solution, rose slightly on Wednesday after basing at a daily low of $0.8438,Wednesday, February 14. The scaling token is up over the past week, offering 6.54% gains to holders. Yet storm clouds may be ahead for MATIC as the volume of tokens being moved from wallets to exchanges has increased dramatically over the past five days – often a sign investors are getting ready to offload their holdings to the market.

According to data from crypto intelligence tracker Santiment, MATIC Supply on Exchanges climbed from 984.06 million on January 27 to 1 billion on Wednesday. The increase in MATIC reserves on exchange wallets is likely to increase selling pressure on the asset, boding negatively for the price.