- Bitcoin price remains above the $65,000 threshold as MicroStrategy makes headlines for the second time this week.

- BTC could have another shot at $69,000 threshold as buyer momentum continues to rise.

- The voluminous acquisition could inspire FOMO in the market ahead of the halving.

Bitcoin (BTC) price could move north soon after the recent all-time high, with four fundamental drivers at play. These are the spot Bitcoin exchange-traded funds (ETFs) theme, the oncoming BTC halving, and voluminous purchases by large holders that continue to drive the fear of missing out (FOMO) aming retail holders.

Also Read: Bitcoin Price Outlook: Almost $521 million in total liquidations as BTC hits new ATH

Bitcoin, altcoins, stablecoins FAQs

Bitcoin is the largest cryptocurrency by market capitalization, a virtual currency designed to serve as money. This form of payment cannot be controlled by any one person, group, or entity, which eliminates the need for third-party participation during financial transactions.

Altcoins are any cryptocurrency apart from Bitcoin, but some also regard Ethereum as a non-altcoin because it is from these two cryptocurrencies that forking happens. If this is true, then Litecoin is the first altcoin, forked from the Bitcoin protocol and, therefore, an “improved” version of it.

Stablecoins are cryptocurrencies designed to have a stable price, with their value backed by a reserve of the asset it represents. To achieve this, the value of any one stablecoin is pegged to a commodity or financial instrument, such as the US Dollar (USD), with its supply regulated by an algorithm or demand. The main goal of stablecoins is to provide an on/off-ramp for investors willing to trade and invest in cryptocurrencies. Stablecoins also allow investors to store value since cryptocurrencies, in general, are subject to volatility.

Bitcoin dominance is the ratio of Bitcoin’s market capitalization to the total market capitalization of all cryptocurrencies combined. It provides a clear picture of Bitcoin’s interest among investors. A high BTC dominance typically happens before and during a bull run, in which investors resort to investing in relatively stable and high market capitalization cryptocurrency like Bitcoin. A drop in BTC dominance usually means that investors are moving their capital and/or profits to altcoins in a quest for higher returns, which usually triggers an explosion of altcoin rallies.

MicroStrategy advances on plans to absorb more Bitcoin

In a March 5 announcement, MicroStrategy, one of the largest BTC holders in the world, revealed plans to absorb more Bitcoin (BTC). The firm’s CEO, Michael Saylor, cited a proposed private offering of $600 million in convertible senior notes.

Barely 48 hours later, Saylor announced having advanced with the plans, detailing the pricing of the offering.

Highlights of the report include:

- The offering was upsized from the previously announced offering of $600 million to $700 million.

- The notes will be sold in a private offering to persons reasonably believed to be qualified institutional buyers.

- Initial purchasers have access within a 13-day period beginning on, and including, the date on which the notes are first issued.

- The offering is expected to close on March 8, 2024, subject to satisfaction of customary closing conditions.

- The notes will be unsecured, senior obligations of MicroStrategy, bearing an interest rate of 0.625% per annum, payable semi-annually.

- The notes will be convertible into cash, shares of MicroStrategy’s class A common stock (initially be 0.6677 shares per $1,000 principal amount of notes), or a combination of cash and shares of MicroStrategy’s class A common stock, at MicroStrategy’s election.

- Estimated net proceeds from the sale of the notes will be approximately $684.3 million. This will be used to acquire additional BTC and for general corporate purposes.

The highlight of the announcement was that the firm added a stark $100 million to the aggregate principal amount. While this was unexpected, it is not really a surprise considering the firm’s strong liking and bullishness toward BTC.

In January, Saylor sold $216 million worth of the company’s stock, MSTR, to buy more Bitcoin. With this manner of BTC bullishness, the firm is steadily edging toward meriting S&P 500 inclusion.

Bitcoin price could retest $69,000

As optimism continues to abound in the cryptocurrency market, Bitcoin price could retake the $69,000 threshold. One analyst on X, @Coinmamba, says, “The probability of Bitcoin topping at $69k twice is very low,” adding that the next retest could see the pioneer cryptocurrency shatter this blockade.

The likely move would be to clear the $69,325 all-time high, recorded on March 5, with the potential to tag the $70,000 psychological level. Such a move would denote an approximate 5% move above current levels.

BTC/USDT 1-day chart

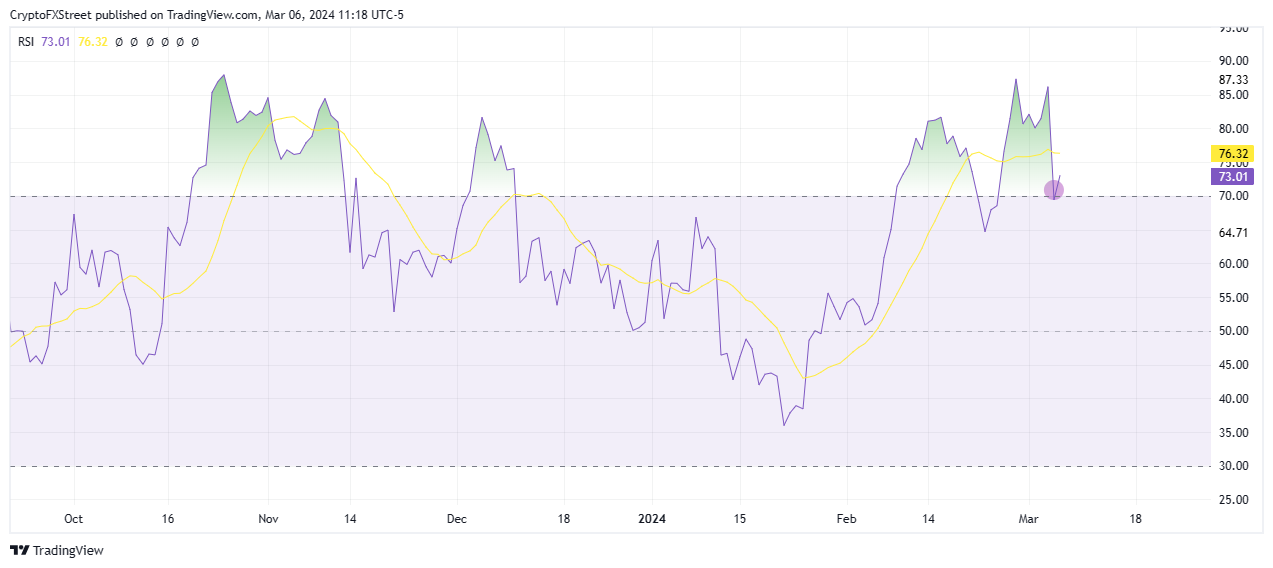

A close look at the Relative Strength Index (RSI) shows that buying momentum is rising after the indicator bounced around the 70 threshold. If this trajectory sustains, the RSI could soon cross above the yellow band of the signal line. Such a crossover would revitalize the uptrend since it is interpreted as a buy signal.

BTC RSI 1-day chart

On the flip side, however, if traders start cashing in on the gains, Bitcoin price could drop to retest the $65,000 threshold. In a dire case, BTC could nosedive to the $60,000 psychological level before another possible leg north.