- Grayscale’s Bitcoin Spot ETF outflows have diminshed this week.

- Bitcoin trades at around $43,000 as its halving event is nearly 81 days away.

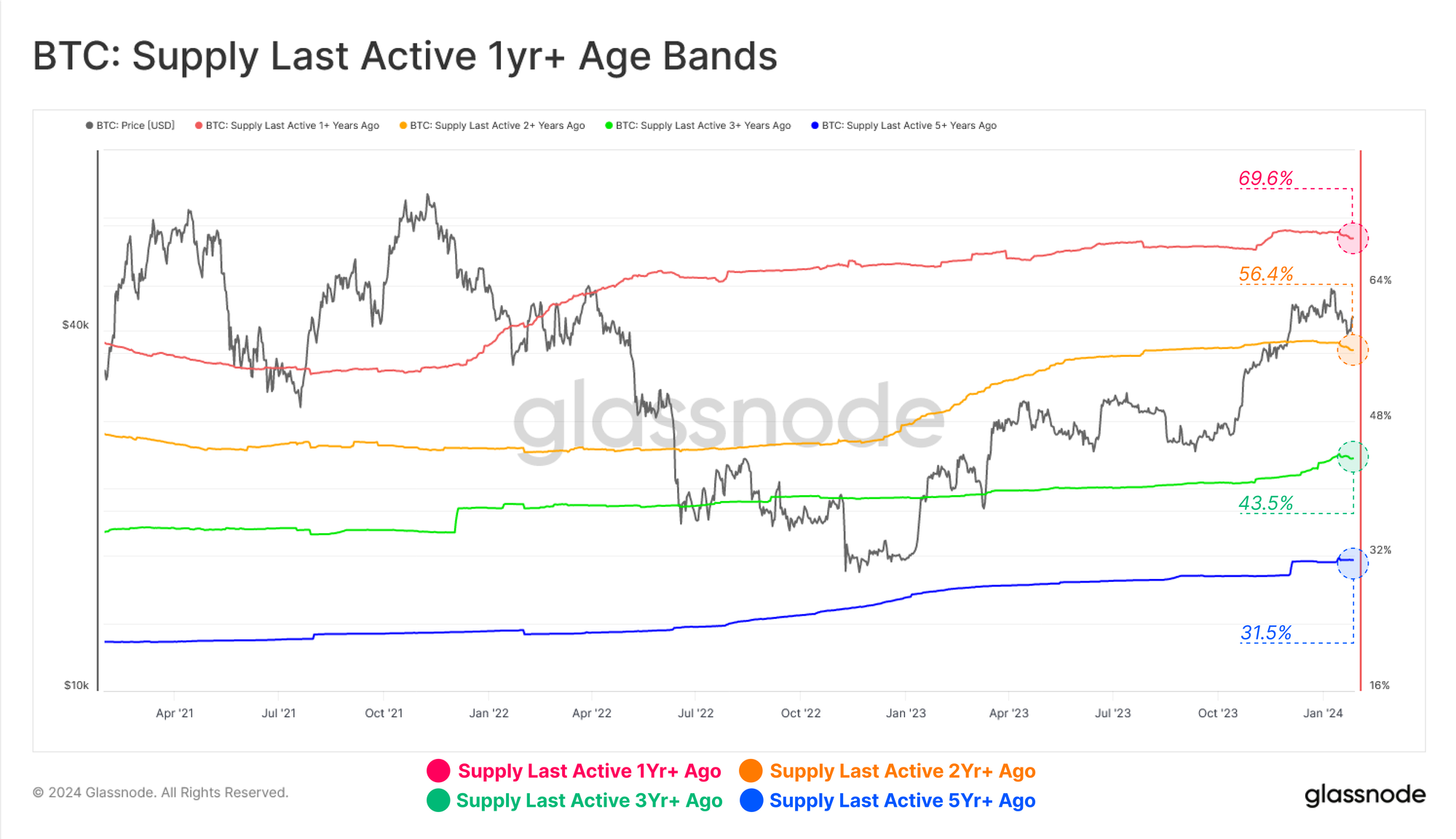

- Bitcoin holder base has held broadly steady, with supply across multiple age bands just below its all-time highs.

Bitcoin’s (BTC) price is recovering this week, trading shy of the $43,000 level on Wednesday’s European morning, after its recent drop to $38,555. Outflows from Grayscale’s GBTC have slowed down this week, easing the selling pressure for Bitcoin and likely catalyzing its recent recovery.

The asset’s holder base has held steady through the recent correction in Bitcoin price, according to data from Glassnode. While a non-trivial volume of older supply has moved in recent weeks, the percentage of BTC supply held across three and five-year bands is just below its all-time high.

Bitcoin’s halving event is 81 days away, according to CoinGecko’s countdown timer. The event is considered a catalyst because previous halvings have led to price gains for Bitcoin.

Also read: Bitcoin price could rally as buying power increases with rise in exchange stablecoin reserves

Daily digest market movers: Bitcoin halving draws close

- Bitcoin price has consolidated in the weeks leading up to the halving event in previous instances.

- The halving is considered a major catalyst for BTC price gains. The market trend surrounding this event typically unfolds in the weeks and months after it.

- If the pattern from the previous halvings repeats, Bitcoin is likely to see a significant recovery from its recent drawdown.

- Apart from the upcoming halving, the recent deceleration of GBTC withdrawals and Bitcoin’s long-term holders staying put has fueled the thesis of a price rally.

- GBTC withdrawals slowed down over the past week, according to data from Bloomberg. As the bleeding ends, Bitcoin could make progress towards its realized cap. Bitcoin’s realized cap is the asset’s actual value that is calculated taking into account the price at which each BTC token was last transacted.

- Glassnode’s recent report on Bitcoin reveals that the realized cap is nearly 5.4% shy of its previous all-time high of $467 billion, amidst strong capital inflows.

- The duration for recovery relies on how quickly the GBTC bleed is plugged.

Bitcoin realized cap drawdown. Source: Glassnode

- Another key metric that supports a bullish thesis for Bitcoin price is the holdings of long-term investors in the three-year and five-year bands. While BTC held by traders for one and two-year periods has been on the move for a few weeks, long-term holders are steady, according to Glassnode data.

- Holdings of Bitcoin’s long-term holder bands are close to their all-time highs, the data shows. This is key to the BTC price gains thesis as holders control a large percentage of Bitcoin supply and are most likely to influence the selling pressure on the asset should they decide to take profits or shed their holdings.

Bitcoin supply last active age bands. Source: Glassnode

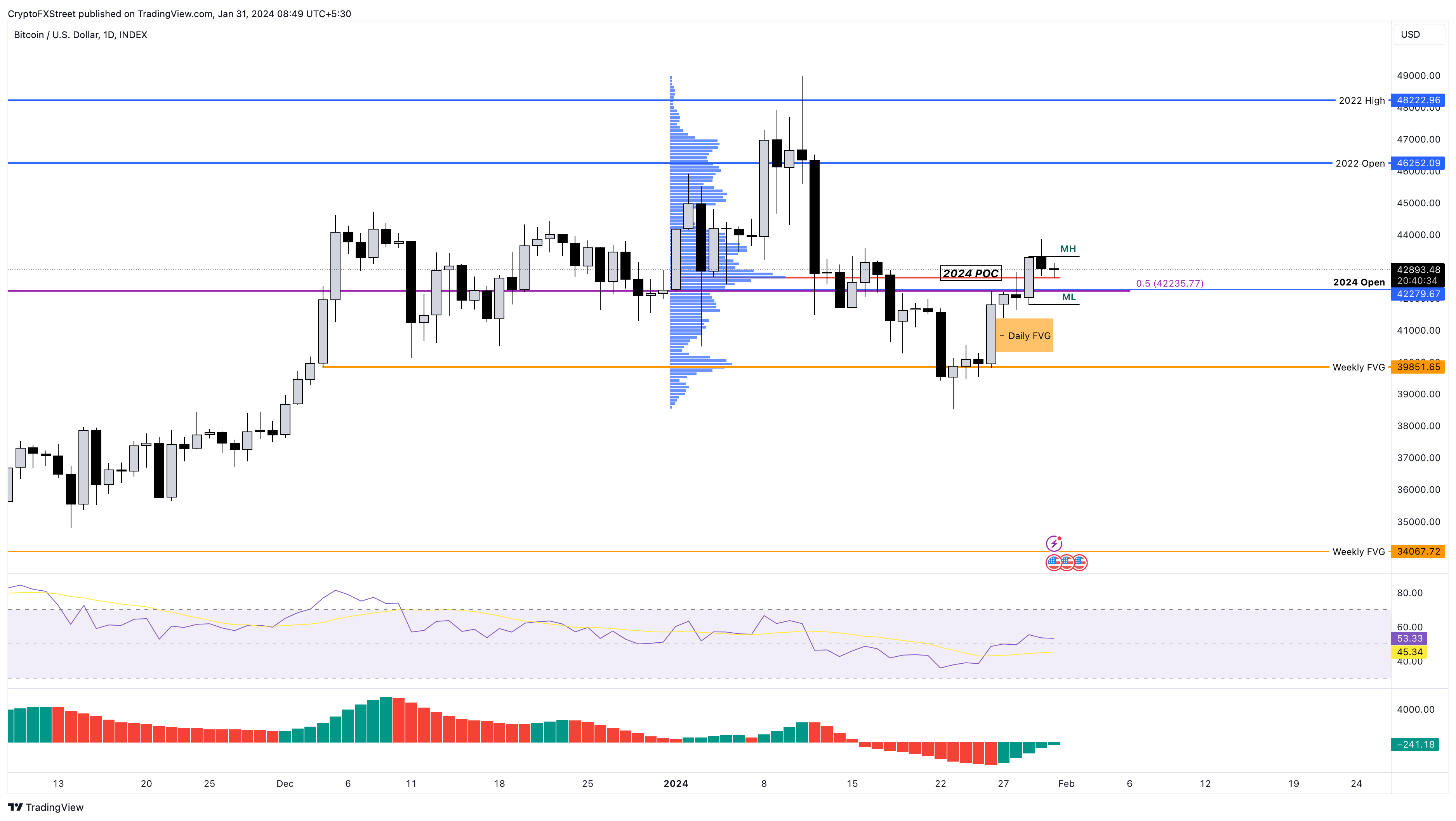

Technical Analysis: Bitcoin price could reveal directional bias soon

Akash Girimath, technical analyst at FXStreet, evaluated the Bitcoin price trend and stated that investors need to be mindful of BTC price action before opening a long position. For a sustained uptrend, BTC price needs a daily candlestick close above the $48,222 level, he said.

BTC/USDT 1-day chart

Until Bitcoin price closes above this key level, the daily imbalance zone that extends from the $41,396 to $40,288 level is an important area to watch.

Traders need to be mindful of a rise in selling pressure that threatens to push BTC price through the imbalance zone and produce a lower low in Bitcoin. BTC could find support at $34,067 and $32,293 in the event of a steep correction.

Cryptocurrency prices FAQs

How do new token launches or listings affect cryptocurrency prices?

Token launches like Arbitrum’s ARB airdrop and Optimism OP influence demand and adoption among market participants. Listings on crypto exchanges deepen the liquidity for an asset and add new participants to an asset’s network. This is typically bullish for a digital asset.

How do hacks affect cryptocurrency prices?

A hack is an event in which an attacker captures a large volume of the asset from a DeFi bridge or hot wallet of an exchange or any other crypto platform via exploits, bugs or other methods. The exploiter then transfers these tokens out of the exchange platforms to ultimately sell or swap the assets for other cryptocurrencies or stablecoins. Such events often involve an en masse panic triggering a sell-off in the affected assets.

How do macroeconomic releases and events affect cryptocurrency prices?

Macroeconomic events like the US Federal Reserve’s decision on interest rates influence risk assets like Bitcoin, mainly through the direct impact they have on the US Dollar. An increase in interest rate typically negatively influences Bitcoin and altcoin prices, and vice versa. If the US Dollar index declines, risk assets and associated leverage for trading gets cheaper, in turn driving crypto prices higher.

How do major crypto upgrades like halvings, hard forks affect cryptocurrency prices?

Halvings are typically considered bullish events as they slash the block reward in half for miners, constricting the supply of the asset. At consistent demand if the supply reduces, the asset’s price climbs. This has been observed in Bitcoin and Litecoin.