- The United States Consumer Price Index rose by more than anticipated in January.

- The European Central Bank keeps cooling down rate cut expectations.

- EUR/USD keeps posting lower lows, anticipating more slides in the coming days.

The EUR/USD pair is ending a second consecutive week little changed at around 1.0750, although it posted a fresh low for 2024 of 1.0694. The US Dollar soared on Tuesday as the United States (US) reported an uptick in inflation at the beginning of the year.

The US Bureau of Labor Statistics (BLS) reported that the Consumer Price Index (CPI) increased 0.3% MoM and 3.1% YoY in January, surpassing the market expectations. Core figures came in at 0.4% and 3.9%, respectively, higher than anticipated.

Market participants entered panic mode with the news, as combined with the latest solid Nonfarm Payrolls (NFP) report, inflation numbers confirmed the Federal Reserve’s (Fed) stance of maintaining interest rates at record highs for longer and taking more time to process data before loosening monetary policy by trimming interest rates.

In its latest monetary policy meeting, the central bank clarified that there is no rush to cut rates. Chair Jerome Powell disregarded a March cut, and bets were moved to May, but the latter decreased after the CPI’s unexpected advance. According to the CME FedWatch Tool, odds for a May cut fell to 34.6% after peaking at 52.2% in the Fed’s meeting aftermath.

Meanwhile, policymakers flood the wires. Fed officials confirmed Powell’s posture, optimistic about the economic performance, yet at the same time cautious about changing the monetary policy too fast. Generally speaking, officials noted that progress is being made on inflation, but they need more data before taking the next step. The latest speakers summed it up quite clearly. On the one hand, Fed Vice Chair for Supervision Michael Barr declared the central bank remains confident that US inflation is on the way to hitting the Fed’s 2% target, although adding that it is too early to say there will be a soft landing and affirming he needs to see continued good data before advocating for rate cuts.

On the other hand, Federal Reserve Bank of Atlanta President Raphael Bostic noted that the Fed faces no urgency to cut rates given the current strong economy, which “argues for patience in adjusting monetary policy.”

Across the pond, Eurozone data failed to impress, to say the least. The German ZEW Survey on Economic Sentiment improved in February, although the assessment of the current situation plummeted to -81.7. Also, the EU reported the December Trade Balance posted a surplus of €16.8 billion, down from the previous €20.3 billion and missing expectations. On a positive note, Industrial Production rebounded in December, up 2.6% against the 0.2% decline expected.

In other order of news, the European Commission released the latest Economic Growth Forecasts, downgrading growth perspectives to 0.9% for the EU and 0.8% for the euro area. However, inflation is predicted to ease further, as the Harmonised Index of Consumer Prices (HICP) inflation in the EU is set to decline faster from a steep 6.3% in 2023 to 3.0% in 2024, further dropping to 2.5% in 2025.

Finally, European Central Bank (ECB) President Christine Lagarde testified before the Committee on Economic and Monetary Affairs of the European Parliament. Lagarde repeated that the central bank still needs more information before it can affirm inflation is heading back toward the desired 2% target.

“The latest data confirms the ongoing disinflation process and is expected to bring us gradually further down over 2024,” Lagarde said.

She also added that the Governing Council needs additional data to determine whether the decline is sustainable in time. Finally, she noted that wage growth remains strong and could affect inflation dynamics. ECB officials throughout the week backed her cautious message. Lagarde was forced to admit rate cuts could come in the European summer, back when she assisted the Davos forum, but the case for a rate cut in the first half of the year is quite weak.

Following the release of the US CPI, stocks plummeted, and government bond yields soared to multi-week highs, reflecting market concerns about economic health and persistently high rates. The movements slowly reverted throughout Wednesday and Thursday, but stocks´ decline and yields’ strength returned ahead of the weekly close following the release of fresh US inflation-related data. The country released the January Producer Price Index (PPI), which rose more than anticipated. The PPI rose 0.9% YoY, easing from the previous 1% but above the 0.6% expected. The core annual reading rose 2%, up from a previously revised 1.8%.

Ahead of the weekly close, the 10-year Treasury yield is reaching fresh highs beyond the 4.30% mark, pushing the US Dollar up.

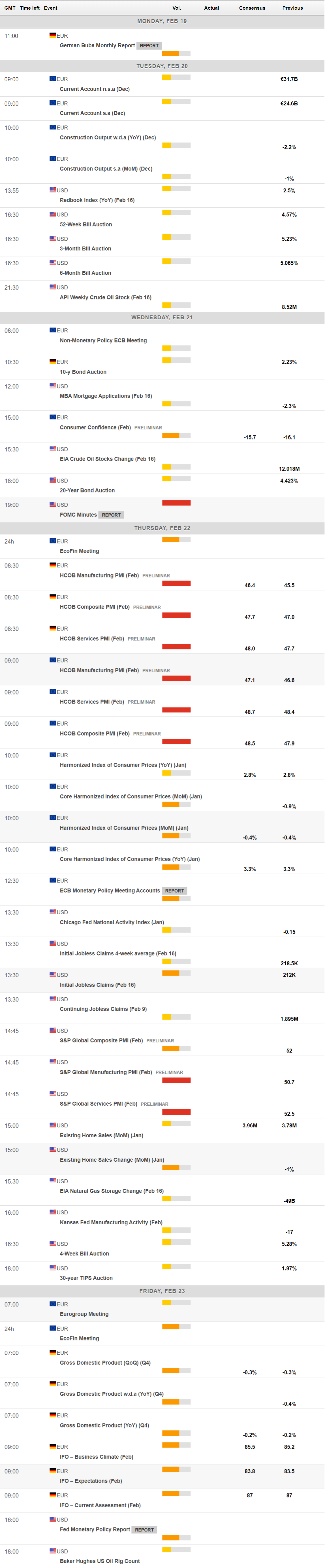

The upcoming week’s calendar features the Federal Open Market Committee (FOMC) Minutes from January and the S&P Global preliminary estimates of the February Producer Manager Indexes (PMIs). Other than that, the EU will publish inflation revisions, while Germany will offer updates on the Q4 Gross Domestic Product (GDP).

The EUR/USD pair retains its bearish potential in the long-term perspective. The weekly chart shows the pair met sellers around a mildly bullish 20 Simple Moving Average at around 1.0800 while developing above a bearish 100 SMA. Technical indicators extended their declines but with uneven strength. On the one hand, the Momentum indicator is pretty much flat around its 100 level, while the Relative Strength Index (RSI) indicator heads south at around 45. The risk skews to the downside, with the aforementioned 100 SMA providing dynamic support in the 1.0620 area.

Technical readings on the daily chart support a downward extension beyond the yearly low at 1.0694. EUR/USD stands below all its moving averages, with selling interest aligned around the 100 SMA at 1.0792. The 20 SMA heads firmly lower a handful of pips above the longer one, reflecting solid selling interest. Finally, technical indicators have turned marginally lower within negative levels, losing their positive momentum and also favoring another leg south.

In the case where 1.0620 gives up, additional support can be initially found at 1.0550, followed by the 1.0490 level. The 1.0790/0800 region is the first resistance area, although EUR/USD needs to recover beyond the 1.0840/50 area to be able to extend gains toward the 1.0930 price zone.