- Arkham price action has consolidated within an ascending parallel channel, signaling an impending breakdown.

- ARKM could drop nearly 40% to $0.40 in the long run amid fading Nvidia earnings euphoria.

- A break and close above the $0.89 range high would invalidate the bearish thesis.

Arkham (ARKM) price is trading with a bullish bias, consolidating above an ascending trendline to the downside. However, its upside potential is capped by another ascending trendline. The two technical formations form an ascending or rising channel.

Also Read: AI coins Render, Akash Network, Fetch.ai rally on opening of world AI Cannes Festival

Arkham price readies for a break down

Arkham (ARKM) price acting has formed an ascending channel, contained by two ascending trendlines that hint at a future convergence. This is because the lower trendline is steeper than the upper trendline, such that the lows are climbing faster than the highs. The technical formation suggests a possible break downwards.

If the technical formation plays out, the AI crypto coin could break below the lower boundary of the technical formation, potentially going as low as the $0.40 psychological level. Such a move would constitute a 40% fall below the current price action.

In a dire case, the slump could send Arkham price all the way down to the $0.05 range low.

ARKM/USDT 1-day chart

On-chain metrics to support Arkham price bearish outlook

Santiment’s daily active addresses metric has been dwindling over the past few weeks, which is bearish as there are no new addresses being created in favor of ARKM. It points to low crowd interaction, bolstering the bearish thesis.

Also, the social dominance and social volume metrics are abysmal, with the shrinking chatter around ARKM token suggesting investor focus in other projects.

ARKM Santiment: Daily active addresses, social dominance, social volume

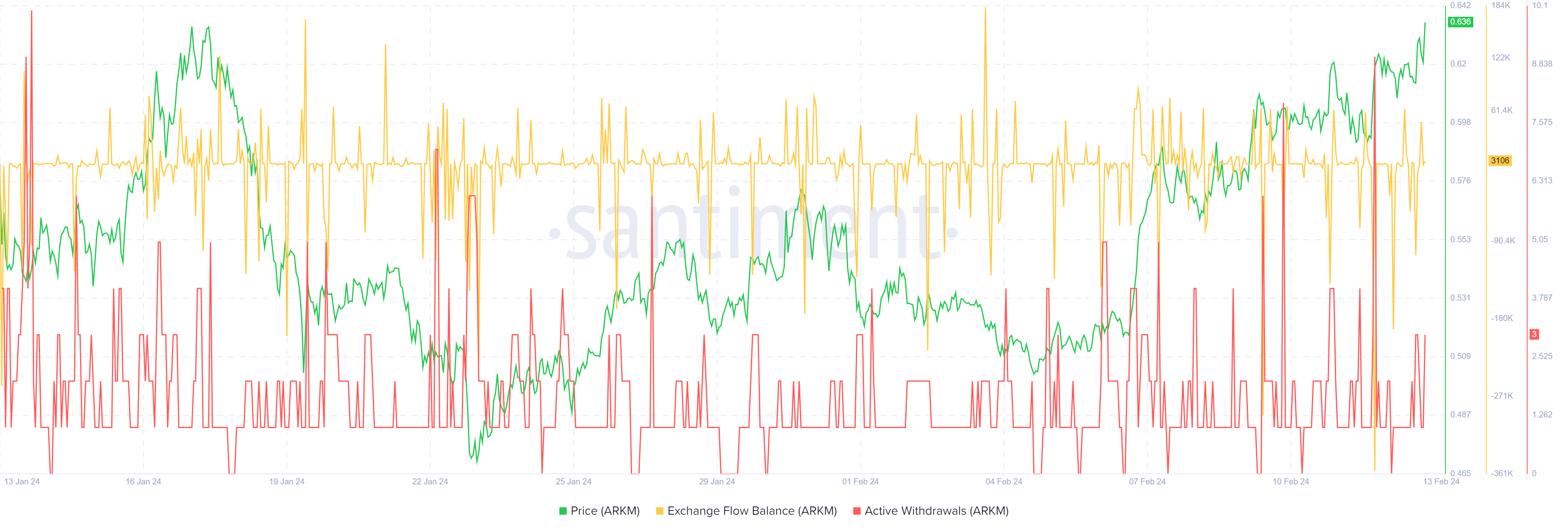

Furthermore, the exchange flow balance is positive, which means the amount of ARKM tokens that have flowed into exchanges are more than those that have left. This suggests increasing intention to sell and is reinforced by dwindling active withdrawals, as ARKM holders prefer having their holdings in exchange wallets, ready to sell.

ARKM Santiment: Exchange flow balance, Active withdrawals

On the flipside, if buyer momentum increases, the Arkham price could shatter past the upper boundary of the ascending wedge pattern to reclaim the $0.8900 level. A break and close above the blockade would invalidate the bearish thesis, setting the stage for a continuation of the intermediate trend.

In a highly bullish case, the Arkham price could extend a neck higher to the $1.0000 psychological level, around 55% above current levels.

%20%5B22.03.20,%2013%20Feb,%202024%5D-638434519323278481.png)