In this comprehensive analysis, we delve into Nvidia’s financial performance and uncover hidden insights about the company. From its soaring revenue figures to nuanced aspects of its valuation, we explore key metrics and trends that shape Nvidia’s standing in the market. Through a detailed examination, we aim to provide a deeper understanding of Nvidia’s financial landscape and uncover valuable insights that may not be immediately apparent.

Highlights:

- Company Overview and Key Products Driving Success.

- Nvidia’s fourth quarter and fiscal year 2024 financial results showcase record-breaking achievements, with remarkable revenue growth and earnings per share surges.

- Despite geopolitical challenges, particularly chip export restrictions to China, Nvidia remains resilient and proactive in navigating regulatory complexities while sustaining market relevance.

- An in-depth valuation analysis reveals both the potential overvaluation of Nvidia’s stock and promising growth trajectories, offering investors valuable insights into the company’s market position and future prospects.

Founded in 1993, Nvidia has solidified its position as a global leader in the design and manufacture of graphics processing units (GPUs) and system-on-a-chip (SoCs) units, catering to diverse markets including professional, gaming, mobile computing, and automotive sectors. The company’s journey has been marked by groundbreaking advancements in technology, shaping the landscape of gaming, artificial intelligence, and autonomous driving.

At the core of Nvidia’s success are its GeForce GPUs, renowned for their unparalleled performance in gaming, professional visualization, and high-performance computation in data centers. These GPUs not only power immersive gaming experiences but also serve as fundamental components in artificial intelligence models, accelerating machine and deep learning capabilities. Moreover, Nvidia’s Drive platform stands as a testament to its commitment to innovation, providing the computing infrastructure essential for the development of autonomous vehicles.

Catering to the needs of professionals, Nvidia offers Quadro GPUs optimized for design, visualization, and simulation tasks, delivering unmatched precision and performance. Complementing its hardware offerings, Nvidia’s GeForce NOW platform revolutionizes gaming through cloud infrastructure, enabling users to stream games seamlessly across various devices, eliminating the need for high-end hardware.

Beyond hardware, Nvidia excels in software development, with CUDA being a prime example of harnessing GPU power for enhanced computing performance. The acquisition of Mellanox Technologies in 2020 further expanded Nvidia’s capabilities, integrating networking and interconnect technology into its extensive portfolio.

As Nvidia continues to push the boundaries of innovation, its impact reverberates across industries, driving progress and transforming the way we interact with technology. With a legacy built on vision and ingenuity, Nvidia remains at the forefront of shaping the future of computing and redefining possibilities in a rapidly evolving digital landscape.

Jensen Huang, the co-founder of graphics-chip giant Nvidia in 1993, has been at the helm as its CEO and president since its inception. With approximately 3% ownership in Nvidia, which went public in 1999, Huang’s leadership has been instrumental in driving the company’s exponential growth and innovation.

Born in Taiwan and raised in Thailand during his childhood, Huang’s journey to success took a transformative turn when his family sent him and his brother to the United States amidst civil unrest in their native country. This early experience instilled in him a resilience and determination that would shape his entrepreneurial path.

Under Huang’s guidance, Nvidia has emerged as a dominant force in the realm of computer gaming chips, expanding its expertise to design chips tailored for data centers and autonomous vehicles. His visionary leadership has propelled Nvidia to the forefront of technological advancement, pioneering breakthroughs in artificial intelligence, deep learning, and high-performance computing.

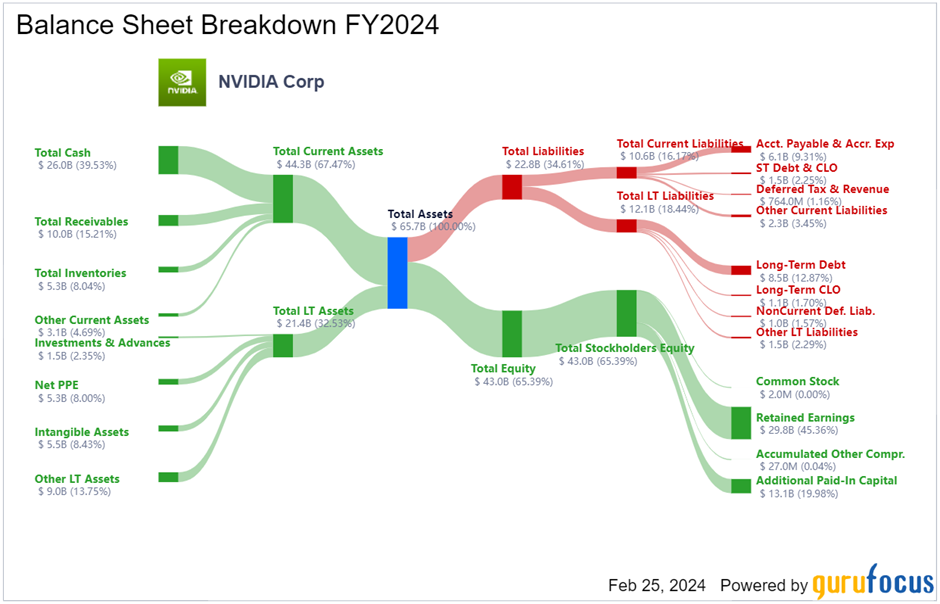

Ndivia Balance Sheet FY 2024:

Beyond his contributions to Nvidia’s success, Huang’s philanthropic endeavors underscore his commitment to education and innovation. He has generously donated $30 million to Stanford University for the establishment of an engineering center, furthering research and academic excellence in the field of technology. In 2022, he extended his support by contributing $50 million to Oregon State University, endowing a namesake research center dedicated to advancing cutting-edge technologies.

Jensen Huang’s remarkable journey from humble beginnings to spearheading one of the world’s leading technology companies serves as a testament to his unwavering vision, determination, and commitment to excellence. As he continues to shape the future of technology, Huang’s legacy remains an inspiration to aspiring entrepreneurs and innovators worldwide.

Computer components typically don’t have the transformative power to reshape entire industries, but Nvidia Corp. defied expectations with the release of its graphics processing unit in 2023. The H100 data center chip has been a game-changer, propelling Nvidia’s value by over $1 trillion and elevating the company to the status of an AI kingmaker virtually overnight. This development underscores the tangible realization of the buzz surrounding generative artificial intelligence, particularly for Nvidia and its primary suppliers. The extraordinary demand for the H100 has led to extended waiting periods of up to six months for some customers.

Transitioning to an explanation of Nvidia’s H100 chip, it’s a graphics processor paying homage to computer science luminary Grace Hopper. Unlike conventional chips found in PCs, the H100 is optimized to handle massive volumes of data and computations at unprecedented speeds, making it ideally suited for the resource-intensive task of training AI models. Nvidia’s pioneering efforts, dating back almost two decades, have paved the way for this innovation, anticipating the future demand for chips beyond gaming applications.

Delving into the unique attributes of the H100, it’s essential to understand its significance in the realm of generative AI platforms. These platforms excel at tasks like text translation, report summarization, and image synthesis through extensive training on vast datasets. The H100, boasting four times the speed of its predecessor, the A100, in training large language models (LLMs), and exhibiting a 30-fold increase in responsiveness to user queries, holds immense value for companies striving to enhance their AI capabilities. In the race to train LLMs for novel tasks, the performance advantage offered by the H100 proves to be pivotal.

Nvidia maintains its competitive edge through swift adaptation and continuous innovation. Notably, the company swiftly updates its offerings, integrating software to complement its hardware at a pace unparalleled by its competitors. Transitioning seamlessly between hardware and software enhancements, Nvidia remains at the forefront of technological advancement. Moreover, Nvidia’s strategic approach includes the development of cluster systems, facilitating bulk purchases of H100s and expedited deployment for its customers. While chips like Intel’s Xeon processors boast capabilities in intricate data analysis, they pale in comparison to Nvidia’s offerings. With fewer cores and slower processing speeds, Intel’s alternatives struggle to match Nvidia’s efficiency, particularly in handling vast datasets crucial for AI software training. Reflecting its prowess, Nvidia’s data center division reported an astounding 81 percent surge in revenue, reaching $22 billion in the final quarter of 2023, underscoring its dominance in the market.

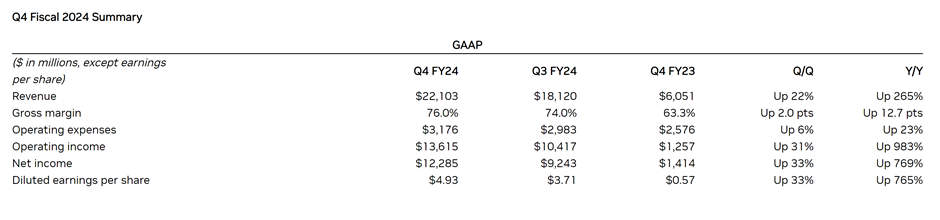

NVIDIA (NASDAQ: NVDA) has announced its financial results for the fourth quarter and fiscal year 2024, showcasing record-breaking achievements that underscore its robust growth trajectory.

In the fourth quarter ended January 28, 2024, NVIDIA reported record quarterly revenue of $22.1 billion, marking a remarkable 22% increase from the previous quarter and an astonishing 265% surge from the corresponding period a year ago. The company also witnessed a historic quarter in Data Center revenue, reaching $18.4 billion, up by an impressive 27% from the third quarter and a staggering 409% from the same period last year.

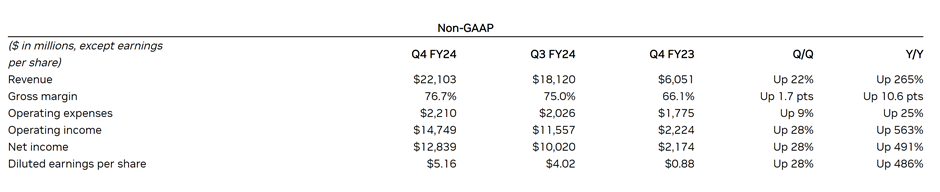

For the quarter, GAAP earnings per diluted share soared to $4.93, reflecting a notable 33% rise from the previous quarter and an outstanding 765% surge from a year ago. Meanwhile, non-GAAP earnings per diluted share stood at $5.16, marking a commendable 28% increase from the previous quarter and an impressive 486% rise from a year ago.

For fiscal 2024, NVIDIA reported record-breaking revenue of $60.9 billion, showcasing an extraordinary 126% growth trajectory. GAAP earnings per diluted share for the fiscal year amounted to $11.93, representing a remarkable 586% surge from the previous year. Additionally, non-GAAP earnings per diluted share reached $12.96, marking an impressive 288% increase from the previous year.

Jensen Huang, founder and CEO of NVIDIA, attributed the stellar performance to the accelerated computing and generative AI, which have reached a tipping point, experiencing a surge in demand across various companies, industries, and nations.

“Our Data Center platform continues to thrive, driven by diverse demand drivers including data processing, training, and inference from large cloud-service providers, GPU-specialized entities, enterprise software, and consumer internet companies,” stated Huang. “Vertical industries such as automotive, financial services, and healthcare have now emerged as multibillion-dollar markets.”

Huang also highlighted the monumental success of NVIDIA RTX, which has evolved into a massive PC platform for generative AI, serving over 100 million gamers and creators worldwide. Looking ahead, Huang teased major new product cycles with groundbreaking innovations set to propel the industry forward.

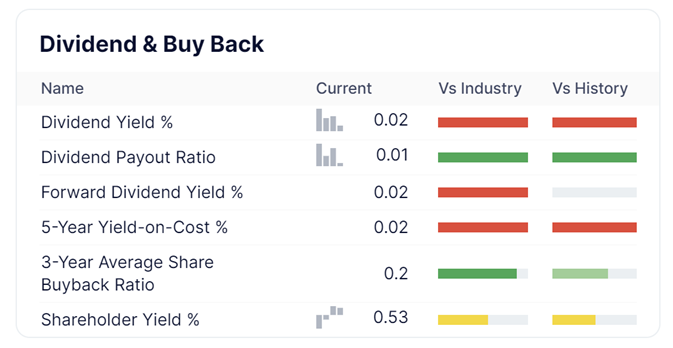

NVIDIA is scheduled to pay its next quarterly cash dividend of $0.04 per share on March 27, 2024, to all shareholders of record on March 6, 2024.

Investors and enthusiasts alike are eagerly anticipating the company’s future unveilings and are invited to join NVIDIA at the upcoming GTC event next month, where the company and its ecosystem will showcase the exciting future ahead.

Q4 Fiscal 2024 Summary:

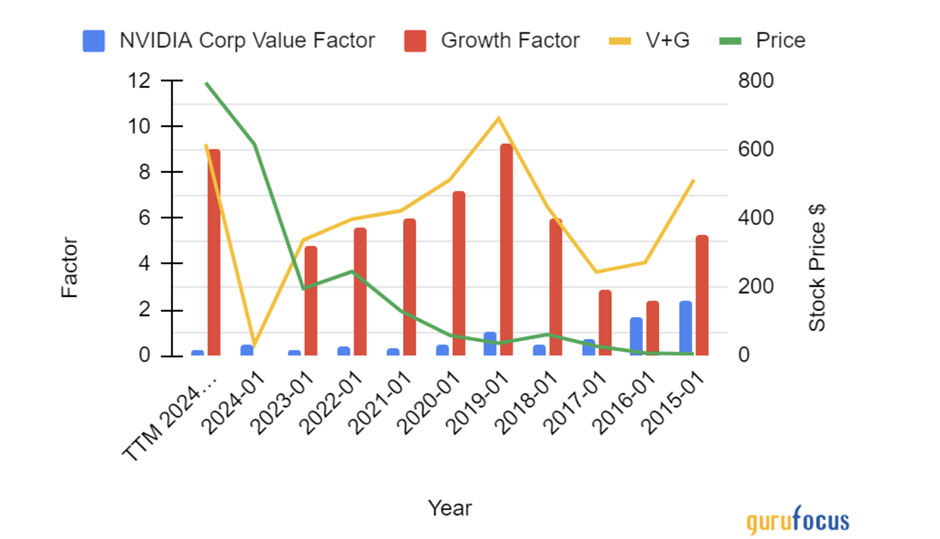

Let’s delve deeper into Nvidia’s financial performance. It’s crucial to contextualize its growth against the backdrop of the anticipated Compound Annual Growth Rate (CAGR) in the AI market over the coming decade. This analysis aims to determine whether Nvidia’s current stock valuation aligns with its historical trajectory.

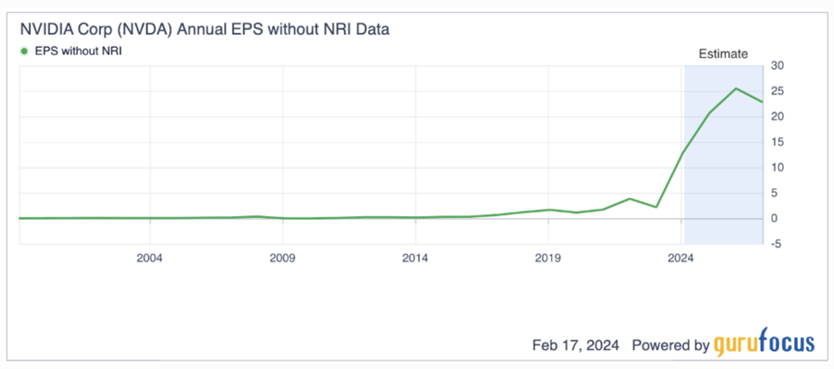

In the preceding year, Nvidia achieved an unprecedented growth in its earnings per share, excluding non-recurring items, at a staggering rate This figure stands in stark contrast to its 10-year average of 34.30%, underscoring a remarkable acceleration in earnings growth.

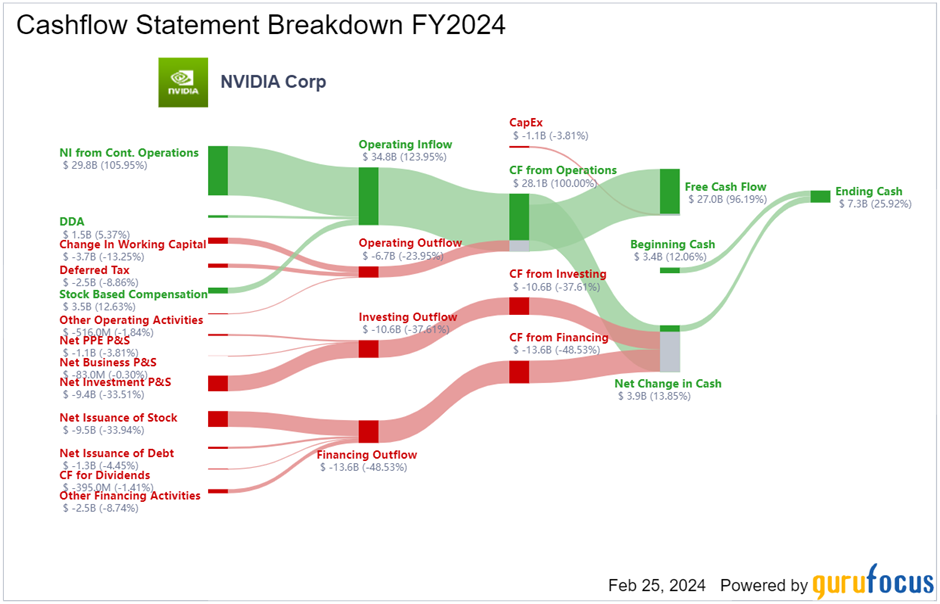

Furthermore, the company has exhibited a remarkable surge in free cash flow, soaring by 269.10% in the past year and maintaining an average annual growth rate of 28.50% over the past decade. Such robust cash flow dynamics underscore Nvidia’s financial resilience and capacity for sustained growth.

Amidst the dynamic landscape of Nvidia’s industry, which arguably ranks among the fastest-growing markets globally, there exists a palpable potential for the company to sustain an earnings per share growth rate of 20% or higher over the ensuing decade. However, prudent analysis necessitates a tempered expectation, considering Nvidia’s established market presence and the projected CAGR of the industry.

In light of these considerations, it is reasonable to anticipate a slight adjustment in future earnings growth, albeit remaining in line with the common consensus. Nvidia’s trajectory in the coming years promises to be emblematic of its adaptability and innovation, charting a course that mirrors the transformative evolution of the technology sector at large.

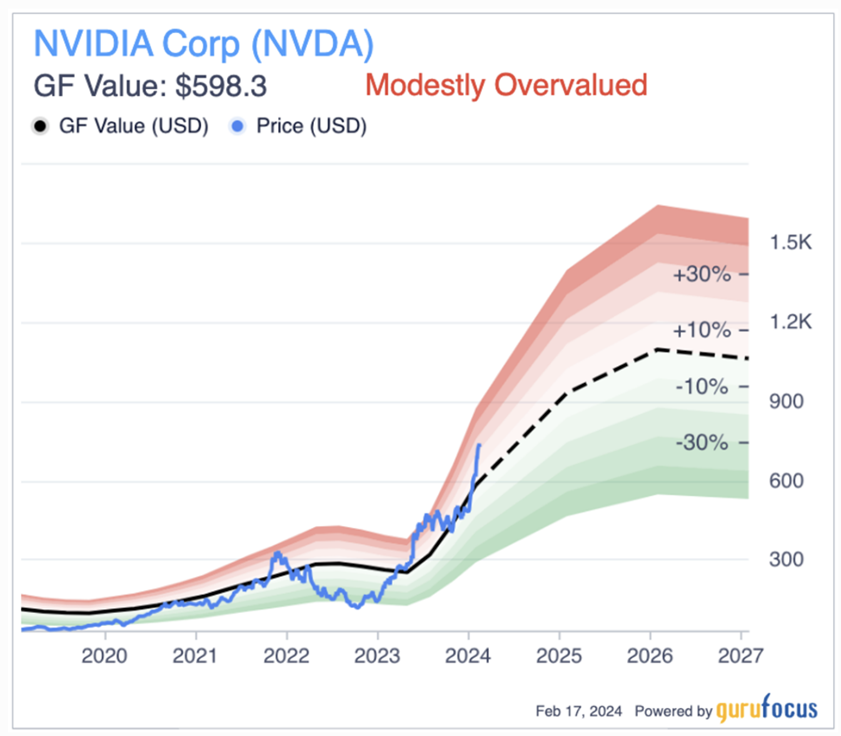

In examining the stock valuation of Nvidia, the most significant concern that emerges is its current price, which stands as the primary risk for potential investors. With a price-earnings ratio hovering around 96, albeit lowering to approximately 36 based on future earnings estimates, Nvidia’s forward price-earnings ratio positions it in the lower echelon, ranking among the bottom 30% within the semiconductors industry.

Conventional discounted cash flow analysis suggests that Nvidia appears overvalued, yet this method may not fully encapsulate the premium often attributed to high-tech stocks. Thus, resorting to a peer analysis emerges as a more pragmatic approach to evaluate technology company valuations.

Comparing Nvidia against peers such as AMD, Taiwan Semiconductor, and Broadcom offers valuable insights. AMD boasts a forward price-earnings ratio of 52, Taiwan Semiconductor stands at 18, and Broadcom at 27. Relatively, Nvidia’s valuation does not seem exorbitant when juxtaposed with its counterparts. However, a discernible moderate overvaluation persists, as highlighted by the GF Value Line.

Delving into future earnings estimates, with 44 analysts anticipating a 72.32% year-over-year growth in January 2025 and 30 analysts foreseeing a 24.24% growth in January 2026, Nvidia presents promising upside potential in the forthcoming years. Nevertheless, investors must anticipate market reactions as earnings growth stabilizes. This might entail sustaining a premium valuation or a plausible decline towards a more rational level, thus potentially fostering short-term volatility before a more conservative growth trajectory ensues.

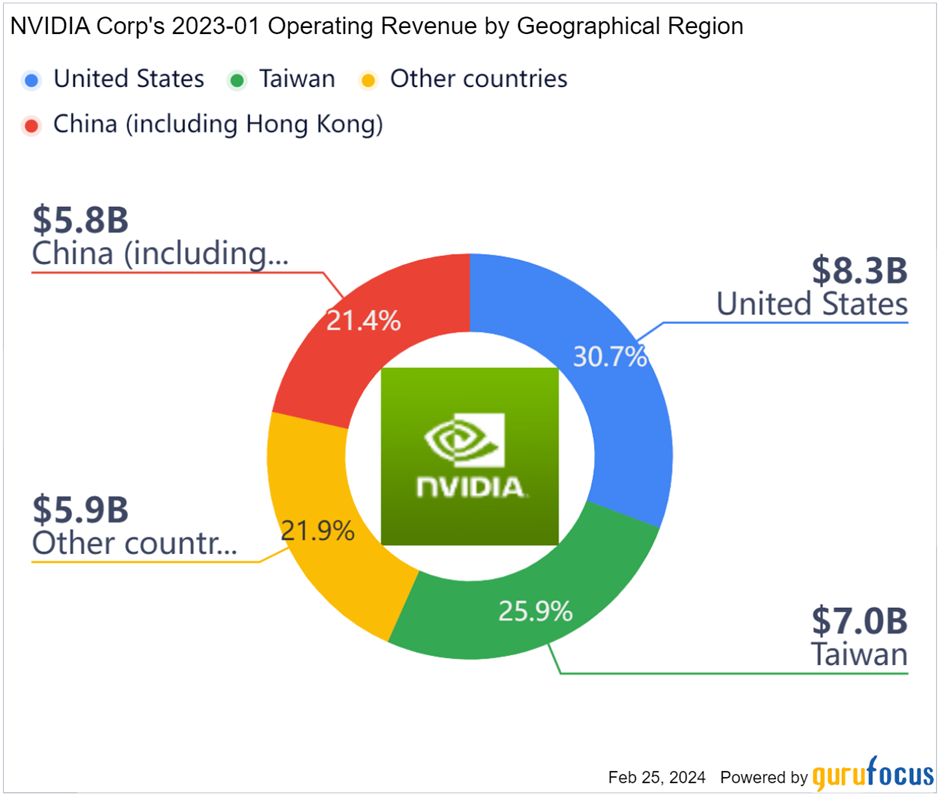

As Nvidia navigates its valuation landscape, geopolitical dynamics, particularly chip export restrictions, emerge as a significant consideration. The impact of these restrictions, particularly in relation to China, warrants close scrutiny given its potential implications on revenue streams and market dynamics.

“Growth was strong across all regions except for China, where our data center revenue declined significantly following the US government export control regulations imposed in October,” remarked Kress, shedding light on the tangible repercussions of regulatory interventions.

Declines stemming from the U.S. restrictions on chip exports to China have drawn concern from investors, amplifying uncertainties surrounding Nvidia’s market performance. Analysts, however, suggest that apprehensions regarding these restrictions may be exaggerated, urging for a nuanced assessment of their true impact.

In response to the regulatory landscape, Nvidia acknowledges the challenges posed by the restrictions, yet remains proactive in mitigating their adverse effects. Despite the absence of licenses from the U.S. government to ship restricted products to China, Nvidia has swiftly pivoted, initiating shipments of alternatives that circumvent the need for licensing, underscoring the company’s agility in adapting to regulatory constraints.

Notably, Nvidia elucidates that China represents a “single-digit percentage” of data center revenue for the fourth quarter of the 2024 fiscal year, with similar projections anticipated for the current quarter. While the constraints imposed by export regulations pose operational challenges, Nvidia remains committed to navigating the Chinese market under evolving regulatory frameworks.

“At the core, the U.S. government wants to limit the latest capabilities of Nvidia’s accelerated computing and AI to the Chinese market, and the U.S. government would like to see us be as successful in China as possible,” elucidated Huang, emphasizing the strategic imperative of aligning with regulatory objectives while pursuing market competitiveness.

As Nvidia charts its course amidst geopolitical headwinds, the company’s resilience and adaptability underscore its capacity to navigate regulatory complexities while sustaining market relevance. In an environment characterized by regulatory uncertainties, Nvidia’s strategic maneuvers reflect a commitment to preserving market integrity and fostering sustainable growth amidst evolving geopolitical dynamics.

However, geopolitical dynamics present a pertinent risk factor, particularly Nvidia’s close ties with Taiwan Semiconductor. Amidst escalating tensions between China and the U.S. concerning Taiwan, the specter of geopolitical unrest looms large. While the likelihood of an invasion remains speculative, prudence dictates caution in allocating heavily to technology stocks amidst such uncertainties. In the event of heightened geopolitical tensions, technology stocks are poised to bear the brunt of adverse impacts, albeit reverberating across all sectors.

In conclusion, Nvidia’s financial performance highlights its robust growth trajectory, despite facing geopolitical challenges and potential overvaluation concerns. The company’s resilience in navigating regulatory complexities underscores its adaptability and commitment to sustaining market relevance. As Nvidia continues to innovate and shape the future of technology, investors and enthusiasts alike remain poised to witness its exciting advancements and market evolution in the coming years.