Where to look for 5X gains … the coming imbalance in supply/demand for this critical metal … we’re deep in the “bust” part of the cycle … where Eric Fry is looking for opportunities

Right now, an investment opportunity is shaping up that has the potential to make you multiples on your money over the next three-to-five years.

You might balk at the idea of waiting that long for this idea to play out. But think of it this way…

Your average S&P stock returns about 7% per year when adjusted for inflation. That won’t get you anywhere close to a 5X return in five years.

Meanwhile, your Mag 7 stocks have been amazing over the last 18 months, but based on their current valuations and gargantuan sizes, they’re not going to 5X anytime soon. That’s not a knock against their businesses, it’s just basic mathematics.

Your more realistic shot at 5Xing your wealth comes from cutting-edge artificial intelligence stocks. And, in fact, we encourage you to speculate safely in that corner of the market. In recent weeks, we’ve been bringing you all sorts of AI ideas from our experts, Louis Navellier, Eric Fry, and Luke Lango.

But being realistic, it’s unclear which stocks will be tomorrow’s AI dominators. So, while you swing for the fences, you may encounter some strikeouts too, and that can be tough on the nerves.

That leaves today’s idea.

It’s anything but a strikeout and should be far easier on the nerves when its inevitable “boom” upswing begins. I write this with confidence because we have decades’ worth of boom/bust cycle data suggesting how this will play out (we’re busting now, getting closer to the start of a boom).

Better still, our world is on a collision course with a drastic shortage of what we’re discussing today – yet our cutting-edge technologies can’t operate without it.

So, put it altogether and we have a critical product with enormous demand on the way… yet a coming shortage of supply relative to demand… and we’re currently in the “bust” phase of its life cycle today.

This has the makings of an enormous trade with less likelihood of rollercoaster whipsaws that leave you sick to your stomach with anxiety.

It’s time to look at lithium.

You don’t want to miss the coming boom cycle for lithium

We’re profiling the opportunity today with the help of our macro expert Eric Fry, editor of Investment Report. For decades, Eric has taken advantage of price distortions in lithium and key industrial metals, so when he’s bullish, it’s worth paying attention.

Let’s begin with Eric providing some context for lithium:

As the lightest metal on earth, lithium is very valuable. Since it is the lightest material that can store energy, it has become indispensable for the batteries that power the new digital economy.

We need it for all the devices, gadgets, and sensors in our homes, businesses, and pockets… for large-scale battery farms to capture the power we get from solar and wind farms… and more.

Like all sorts of commodities, lithium operates according to a boom/bust cycle.

Simplistically, here’s how that works: When there’s major demand for the metal, yet not enough supply, prices surge. Meanwhile, the price of top-tier lithium miners usually explodes higher. This is the boom phase.

North Carolina-based lithium company Albemarle (ALB) gives us an example of just how big the gains can be. Between its March 2020 low and its September 2022 high, it jumped 504%.

Source: StockCharts.com

History shows that prices can fall so low that many miners are unable to cover their costs. They go belly-up and new projects are abandoned. Even the companies that survive see their cash flows dry up and stock prices tank. This is the bust phase.

So, where is the lithium cycle today?

Here’s The Wall Street Journal:

If investing is about pouncing at the point of maximum pessimism, lithium stocks must be worth a fresh look.

The metal used to make electric-vehicle batteries has given investors whiplash. Prices rose rapidly in 2021 and 2022 before falling even faster in 2023…

Lithium prices are now too low to justify a chunk of today’s ore extraction in Australia and China, let alone investment in new production necessary to feed expected growth in the EV market. That is setting up the conditions for a shortage and rally.

This classic boom-bust story has played out before in lithium.

The WSJ article highlights 2020, when Tesla accelerated EV production, resulting in a scramble for lithium that sent prices through the roof. But this led to all sorts of new production, eventually triggering oversupply and the conditions for today’s bust phase.

And that bust has been brutal

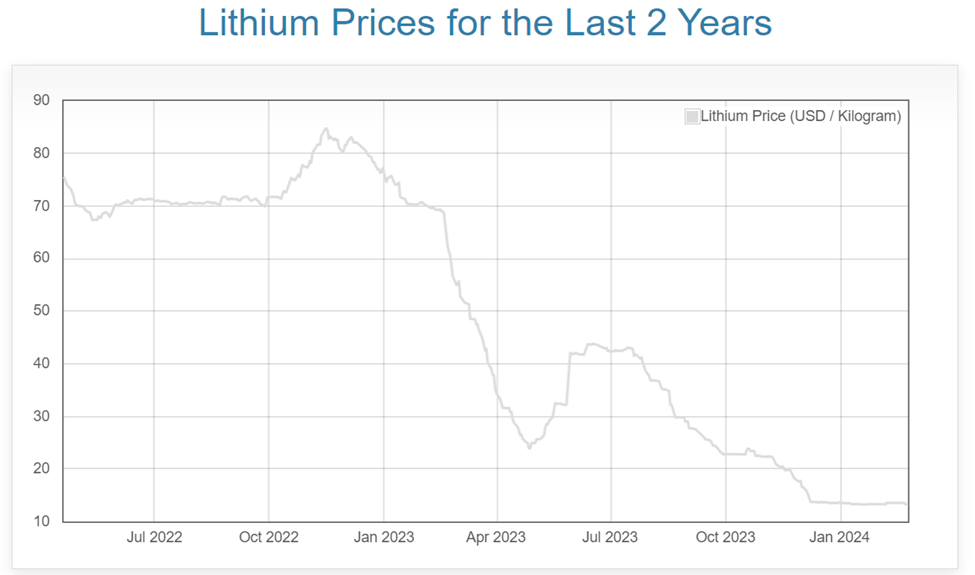

As you can see below, the price of lithium hydroxide hit roughly $85 in the fall of 2022. As I write, it’s fallen to $13.27.

Source: DailyMetalPrice.com

It’s been equally painful for top lithium stocks.

Regular Digest readers may recall our bullish trade on Albemarle in April of last year. It turns out, we caught a smaller bullish move within a much larger, painful 63% bust that began in November of 2022.

Source: StockCharts.com

There’s similar pain in the lithium ETF LIT from Global X. It holds top lithium miners including Pilbara, Mineral Resources, and Quimica.

As you can see below, it’s down 41% over this same general period.

Source: StockCharts.com

Bottom line: Lithium is in its “bust” phase today. That doesn’t mean it will be over tomorrow, but let’s turn our attention to why it’s nearing its end, and the boom that’s on the other side.

How enormous demand and insufficient supply will reward lithium investors

Let’s go back to Eric:

Lithium, like most other commodities, subjects investors to extreme boom-bust cycles. As the current over-supply shifts toward under-supply during the next two years, the bust will end… and a new boom will begin…

The decision to invest in the lithium industry begins with one compelling data point: Global battery cell demand for lithium will soar nearly seven-fold by 2030, according to McKinsey Battery Insights.

If this eye-popping growth projection comes to fruition, battery demand for lithium would account for a whopping 95% of total global demand, and it would become a $400-billion industry.

If you think a seven-fold increase in demand sounds bullish, brace yourself for how this number grows when we extend our timeframe.

From BloombergNEF:

2050 lithium demand from the energy transition alone looks to be about 17.5 times more than demand in 2020.

Here’s Eric’s takeaway:

The combination of new demand from renewable energy, atop traditional demand sources, could produce an explosive multidecade commodity supercycle.

The bottom line is this: Robust future demand growth for battery metals is fairly certain, but the mining industry’s capacity to satisfy that growth has not been.

While these forecasts are “multi-decade,” we’ve already seen that 5X returns are possible on a shorter timeframe. Either way, the likelihood of returns that trounce your average 7%-per-year S&P stock appear to be in the cards.

So how do you play it?

We’ve already pointed toward Albemarle and LIT. We believe both these investments will reward investors handsomely on the other side of today’s bust phase.

But Eric has his eye on a different play:

A remarkable lithium discovery has been made in a deserted area of Nevada…

Just one company is poised to exploit the deposit… and could be only months away from full scale-production…

The company is constructing a major lithium mine in Nevada, and the project currently hosts the largest known lithium resource in the U.S. Additionally, it is the only fully permitted project in the U.S…

Once it begins production later this decade, the lithium mine operation should generate more than $1 billion in gross earnings (EBITDA), then ramp to more than $2 billion by the end of the decade.

These long-range projections are merely estimates, of course. The actual results could be much better than these projections…

You can get the full story from Eric right here.

Regardless of how you choose to play it, a lithium investment deserves your consideration

It’s not clear the bottom is in yet, so we’re not suggesting you dive in recklessly. But there’s a proverbial “blood in the streets” moment here today, yet enormous demand coming tomorrow.

History shows that this set-up has the potential to make foresighted investors a tremendous amount of money. Don’t sleep on this opportunity.

Have a good evening,

Jeff Remsburg