Almost every SME is an international business these days, and you might be wondering how to reduce your FX risk. Exchange rates fluctuate all the time, and keeping track of them is a futile task.

Thankfully, you can manage your FX risk by following a few tried-and-tested tactics.

Before diving into these tactics, here are the types of FX risks you face:

- Transaction risk – Refers to the risk associated with conducting business transactions in different currencies, which stems from the time lag between agreeing to a transaction and its actual settlement.

- Translation risk – Refers to the risk faced by companies with subsidiaries and operations abroad. When consolidating financial statements, translating subsidiary earnings from their respective local currencies into the parent company’s reporting currency may yield gains or losses due to fluctuations in exchange rates.

- Economic risk – Refers to the risk that a company’s market value and cash flows are affected by unavoidable fluctuations in exchange rates. This type of risk typically arises from shifts in macroeconomic conditions, such as geopolitical instability and government regulations.

In addition to understanding FX risk categories, remember to review your FX policy. Aleksandar Stojanovic, CEO and Founder of Fiscallion, a boutique advisory firm focusing on strategic financial leadership, says quantifying exposure is critical.

“Compile a comprehensive list of all foreign currency denominated assets, liabilities, revenues, and expenses,” he says. “Use historical data and forward-looking projections to estimate potential FX impacts on cash flows and financial statements.”

Stojanovic also recommends conducting sensitivity analysis to model the impact of exchange rate volatility on cash flow.

Once you have these basics in place, the tactics below will help you reduce currency risk.

FX risk mitigation tactic #1- Matching currency flows

The terms matching and netting float around a lot when speaking of currency risk management, and you may have wondered what they are.

Matching and netting refer to the same tactic of reconciling complementary FX workflows to reduce FX exposure. That definition is a mouthful, so let us use an example.

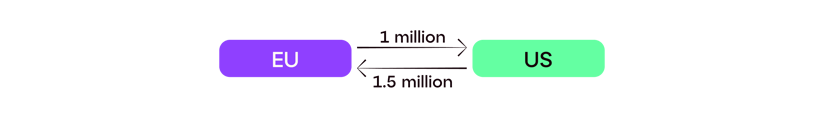

Let’s say your company in the EU must transfer USD 1 million to its American subsidiary. But, the subsidiary must transfer USD 1.5 million back to the EU unit.

“Netting” these currency flows gives us a net cash inflow of USD 500,000 to the EU unit.

Instead of executing two FX transactions, you execute one where the American unit transfers USD 500,000 to the EU, reducing your net currency exposure to USD 500,000.

If this arrangement occurred between your company and a third party, that is a “Matching” transaction.

Here are a few practical examples of using matching and netting beyond two currency flows:

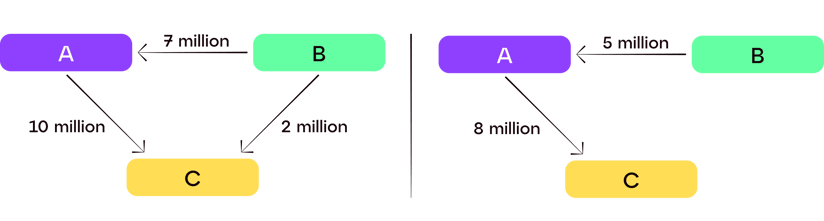

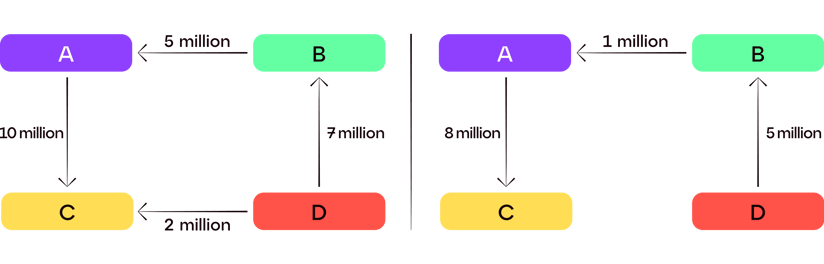

Net three currency flows to two

Net four currency flows to three

When dealing with multi-leg currency flows, roll the smallest transaction amount into the other legs. This way, you’ll reduce your FX exposure by that amount and can net flows no matter how many legs a transaction has.

Remember that matching and netting only work if all transactions occur close to each other and are all conducted in the same currency.

For example, if the opposing flows in our two-party example above occur three months apart, netting them is impossible. After all, they occur too far apart, and you cannot account for them accurately.

FX risk mitigation tactic #2 – FX protection in contracts

If your company has entered lengthy supplier or customer contracts with international entities, adding revenue recovery clauses makes sense.

“Include specific clauses in your contracts that address how currency fluctuations will be managed,” Stojanovic says, “Define the base currency and set exchange rate limits or adjustment mechanisms.”

If a currency pair’s exchange rate deviates beyond an agreed-upon threshold, one party compensates the other for any losses. Let’s look at an example.

- Company A (based in China) agrees to supply Company B (based in the EU.)

- EUR/CNY rate – 7.8412.

- B agrees to pay A CNY 392,060 per shipment (EUR 50,000.)

Now let’s say the EUR/CNY rate moves to 7.998 (a 2% move up.)

- B pays EUR 50,000.

- A receives CNY 399,900 (an excess of CNY 7,840.)

In this situation, Company B could have saved money by transferring fewer EUR since the exchange rate increased. At the new exchange rate, Company B would have had to transfer EUR 49,019. Effectively, B has paid A an additional EUR 980.

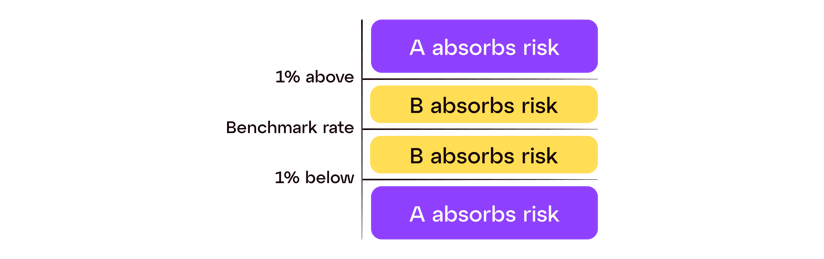

An exchange rate protection clause of 1% would have helped Company B in the following way:

- B transfers the original EUR 50,000 for all exchange rate moves within a 1% variance of the original exchange rate of 7.8412.

- This creates an exchange rate ceiling and floor of 7.9196 and 7.7635 respectively.

- These rates are the maximum and minimum rates Company B will pay Company A.

- If rates move up, the minimum B pays is (CNY 392,060/ 7.9196) EUR 49,505.

- If rates decrease, the maximum B pays is (CNY 392,060/ 7.7635) EUR 50,500.

This arrangement protects Company B’s down and upside. In this example, B absorbs currency

This arrangement protects Company B’s down and upside. In this example, B absorbs currency

exchange risk, guaranteeing its supplier a fixed amount.

In the example above, you’re the one bearing exchange rate risks within a defined exchange rate band. You could flip this situation and assume responsibility for exchange rate moves beyond that band and have your supplier bear exchange rate risks within that band.

One reason for doing this is that moves outside the defined band are less likely to occur. The downside is that if these moves do occur, you’ll bear a significant financial burden. If your supplier heavily depends on your orders, consider initiating this arrangement.

So in our example, Company A would fix a 1% threshold on the EUR’s movements, capping its up and downside. Company B would pay EUR 50,000 no matter what, bearing additional costs only if the EUR/CNY rate breaches the 1% threshold.

Stojanovic says exploring these options as an SME CFO is critical. Whether splitting gains or losses from currency moves or fixing thresholds, you must work with your counterparties to reduce your FX exposure.

“Agree on regular intervals for reviewing and potentially adjusting contract terms based on currency market conditions,” he says. “This ensures that the contract remains fair and relevant over time.”

These arrangements need strong legal help, which might be inaccessible to smaller businesses.

This is why large companies negotiate such agreements amongst themselves.

However, if you have a strong relationship with your counterparty, you could put this tactic into practice.

FX risk mitigation tactic #3 – Transact in local currencies

Perhaps the best way for SMEs to minimise their FX exposure risk is to transact in local currencies as much as possible. For example, if you have several customers in the United States, accept USD from them in a local American account.

If the majority of your suppliers are in Bulgaria, open a local account and pay them in BGN.

Transfer payments in bulk from these accounts to your home currency, and you’ll reduce the impact of currency exchange rate fluctuations.

For example, instead of receiving 100 individual payments from your customers in USD and converting them to EUR, you can consolidate them into one transfer. This means you’ll face currency exchange rate risks on one transaction instead of 100.

While the transaction volume remains the same, you can lock in a single exchange rate and accurately predict your cash flow. Similarly, you can transfer a bulk payment to a local account to pay your suppliers from, guaranteeing they’ll receive the correct amounts in their local currency.

You can fix supplier costs, helping you budget easily, and even score better rates on a bulk transaction.

Now, you might be thinking that opening local accounts in different jurisdictions is challenging for an SME. Thanks to technological solutions like iBanFirst’s currency accounts, you can open an account in a currency of your choice and begin transacting immediately.

While transacting in local currencies is a good way to reduce FX risk, Stojanovic cautions that this tactic won’t always work.

“Indirect exposure may still exist through supply chain costs or investments,” he says. “Also, in some markets, transacting in local currencies may not be feasible due to regulatory restrictions or limited liquidity.”

As a CFO, it’s crucial to weigh these factors and align your currency strategy with your SME’s overall risk management and business objectives.”

FX risk mitigation tactic #4 – Adopt financial FX risk management tools

While the methods discussed earlier can be effective, they come with certain limitations and dependencies. For instance, matching and netting are only feasible if you have closely-timed but opposite FX flows and your finance team is large enough to handle the additional work it entails. Similarly, contractual FX protection agreements rely on the willingness of your suppliers and customers to negotiate. Even local currency accounts, while reducing risk, don’t guarantee favorable currency exchange rates on their own.

To stay on top of FX risk, considering financial FX risk management instruments can often be a more effective choice.

Still, plenty of small businesses shy away from FX derivatives, convinced they’re overly complex and better suited for larger companies. In reality, there’s a range of financial instruments available, from the simplest to the most intricate. Ultimately, it’s about finding the approach and tools that you feel comfortable with and ensuring your FX partner supports you in evaluating your options effectively.

To mitigate risk effectively, consider employing the following instruments in the markets:

Fixed Forward Contracts

Fixed forward contracts enable you to buy or sell a specific amount of foreign currency at a predetermined rate on a specified future date. They provide protection against unfavorable currency fluctuations and facilitate cash management and budgeting processes.

However, it’s essential to note that when you commit to a forward contract, you are obligated to buy or sell the currency at the agreed-upon exchange rate, regardless of the prevailing market rate on the contract’s expiry date.

Flexible Forward Contracts

Flexible forward contracts offer more flexibility by allowing you to secure an exchange rate for a specified amount of currency and utilize it at any time within a designated period. This flexibility comes in particularly handy for businesses with varying transaction timelines. Similar to fixed forward contracts, you are bound by the predetermined exchange rate, regardless of market movements.

FX Options

These products grant you the right, but not the obligation, to exchange one currency for another at a predetermined rate on a future date. In simpler terms, you have the choice to either exercise or decline your option at contract expiry, depending on whether the market rate is more favorable than the option rate, for instance. However, this increased flexibility comes with a higher price tag.

“Consult with financial advisors or treasury management experts specialising in FX risk management,” Stojanovic advises. “They can offer tailored advice and help you navigate the complexities of different financial solutions.”

“Cultivate relationships with banks, financial advisors, and other partners who can support your FX risk management efforts,” he adds. “A strong network can provide valuable insights and resources.”

How well are you managing your FX risk exposure?

Neglecting currency risk could end up being a pricey oversight. Therefore, it’s crucial for all companies dealing in multiple currencies to take the time to understand their currency exposure before deciding on how to mitigate it.

Feeling unsure about which tactics and tools would fit your business best? Get in touch with us! We’re here to help you navigate through it all. Our team of FX experts will work with you to tailor an approach that aligns perfectly with your business goals and comfort level with risk.

FAQs

What is FX risk?

FX risk, or foreign exchange risk, refers to the potential for financial losses arising from fluctuations in currency exchange rates. FX risk, also known as foreign exchange risk, refers to the potential for financial losses that individuals or businesses may encounter as a result of changes in currency exchange rates. This risk arises when transactions involve currencies other than the domestic currency, and fluctuations in exchange rates can impact the value of assets, liabilities, or cash flows.

What is an example of a transaction exposure?

Here is an example of an FX transaction exposure: A company based in the EU records revenues in EUR but receives payments from its customers in USD.

If the EUR/USD exchange rate moves unfavourably, this company could record lower revenues and a loss. In this situation, each transaction where the company converts USD to EUR contains FX exposure and risk.

What are the most common types of FX risk?

The most common types of FX risk are:

- Transaction risk – This arises from conducting business transactions in different currencies, leading to potential losses due to exchange rate fluctuations.

- Translation risk – Faced by companies with subsidiaries abroad, it occurs when translating subsidiary earnings into the parent company’s reporting currency, potentially resulting in gains or losses due to exchange rate fluctuations.

- Economic risk – This arises when a company’s market value and cash flows are impacted by fluctuations in exchange rates, typically driven by shifts in macroeconomic conditions.

What is currency risk management?

Currency risk management is minimising a company’s FX exposure through innovative solutions. Some risk management tactics are:

- Matching and netting currency flows.

- Transacting in local currencies as much as possible.

- Negotiating FX protection in contracts.

- Using financial solutions like FX forwards.

![Week ahead – BoE and RBA decisions headline a calm week [Video]](https://biedexmarkets.com/wp-content/uploads/2024/05/Week-ahead-–-BoE-and-RBA-decisions-headline-a-calm.jpg)